The Impact of Natural Catastrophes and Inflation on Home Insurers in Texas provide challenges, but also opportunities.

Photo credit: Wasan Tita / iStock / Getty Images Plus via Getty Images

The home insurance landscape in Texas is facing unprecedented challenges due to a combination of natural catastrophes and inflationary pressures. While not currently in crisis, the state is experiencing rising concerns, particularly in the aftermath of increased catastrophic events and shifting demographic patterns.

The timely topic was discussed at a Media Roundtable held at the CoreLogic IntrConnect event on January 22. Several high-ranking members of CoreLogic were on hand along with multiple restoration media outlets.

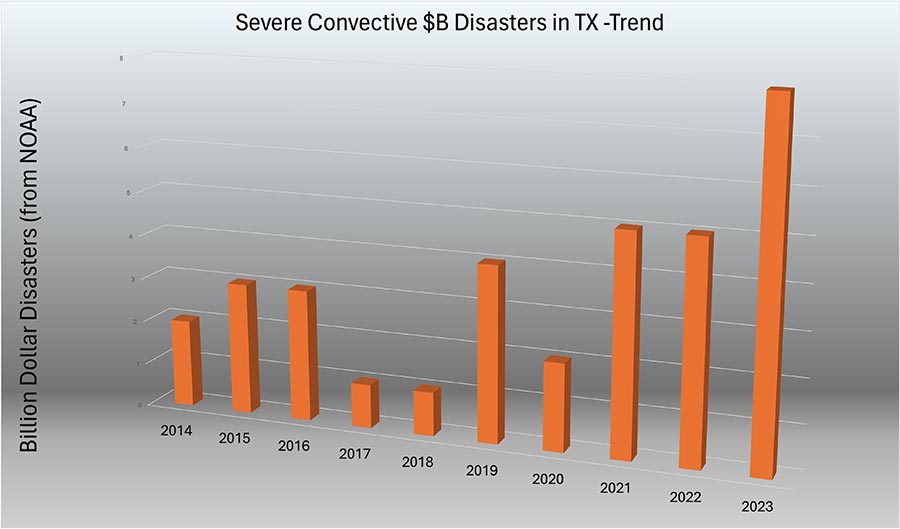

In 2023, Texas witnessed a surge in billion-dollar disasters, surpassing any other state, according to the National Oceanic and Atmospheric Administration (NOAA). The Texas Windstorm Insurance Association (TWIA), the insurer of last resort, is also expanding rapidly, expecting to cover 247,000 policies by the end of 2024, up from 195,000 in 2022. Several factors contribute to this growing concern, including cost inflation in reconstruction, migration patterns leading to urban sprawl, and development in hazard-prone areas.

Credit: CoreLogic

Over the past five years, construction, labor, and material costs have skyrocketed. While material prices began to soften in 2023 after a spike in 2021, labor costs have steadily increased, with signs of more aggressive future hikes. The average reconstruction cost of a "model home" in Texas has risen significantly, from $196,400 in 2018 to $291,266 in January 2024. And this trend isn’t likely to slow down anytime soon. Maiclaire Bolton-Smith, CoreLogic Vice President, Hazard & Risk Management pointed out that the “two givens in the immediate future are “the increasing severity of hazards, and the increasing labor & material costs”

In Texas, the correlation between home prices and flood risk is evident. In Harris County, for every 10-point increase in flood risk score, a home's value decreases by about 2.7%. This poses challenges for homeowners and underscores the importance of considering climate risk in property valuations.

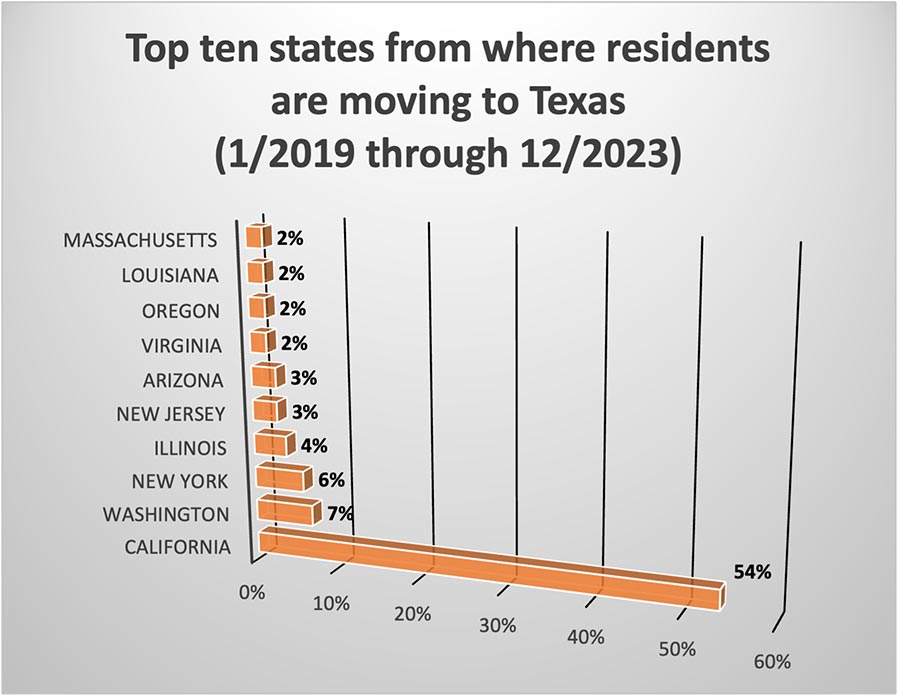

Migration patterns into Texas are reshaping the housing market, driven by factors such as the COVID-19 pandemic, remote work trends, and a desire for more space and lower living costs. Texas has become an attractive destination for out-of-state homebuyers, especially from high-cost states like California and New York.

Credit: CoreLogic

Insurers and regulators are collaborating to navigate a complex regulatory environment, focusing on resilience and mitigation. The key themes include the ability to recover swiftly and fair and transparent claims resolution.

Despite the challenges, there are opportunities for the future. Increased awareness of risk and the availability of insurance can help reduce the insurance gap. CoreLogic President Garret Gray pointed out that “we need a healthy restoration market to have a healthy insurance market” and “there will be more reliance on contractors, through increasing technology, to help bridge the gap”. Emphasizing mitigation efforts, leveraging new technology for risk analysis, and implementing self-service claims for faster resolutions are among the strategies that insurers can explore.

The confluence of natural catastrophes and inflationary pressures is posing significant challenges to home insurers in Texas. However, by addressing these challenges proactively and leveraging emerging opportunities, insurers can adapt to the evolving landscape and continue to provide essential coverage to homeowners in the state.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!