2018 State of the Restoration Industry

Adaptation is the name of the game in business today. Technology is growing at neck-breaking speed and much of the U.S. economy is booming, including the construction industry as a whole. According to a report from the Equipment Leasing and Finance Foundation, the construction industry had record spending in 2017, and they further predicted a 5 percent increase for 2018. The report credited the increased spending largely due to the natural disasters creating an increase in work.

Just as 2017 saw some major weather and catastrophic loss events, like Hurricanes Harvey and Irma, wildfires, tornado outbreaks, and major flooding events, 2018 has had its own array of destruction. As this article is being written, California is experiencing the deadliest wildfire in the state’s history. This fire comes on the heels of major hurricanes striking North Carolina and southern states like Florida. It will likely take years to recover from these disasters. There have also been tornado outbreaks and major winter storms in various parts of the country. The Weather Channel reported the U.S. experienced $6 billion in damage just in the first half of 2018; there is no telling what the total will be once the rest of the year is added.

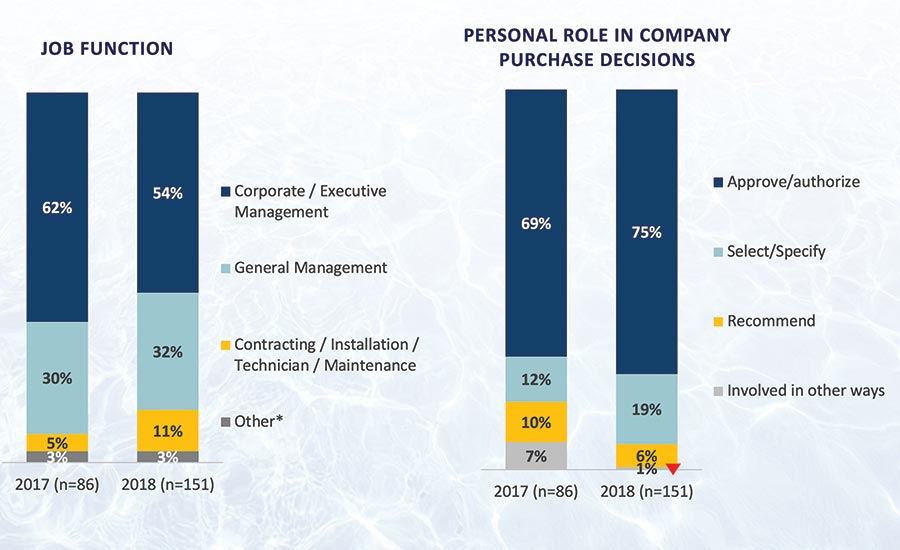

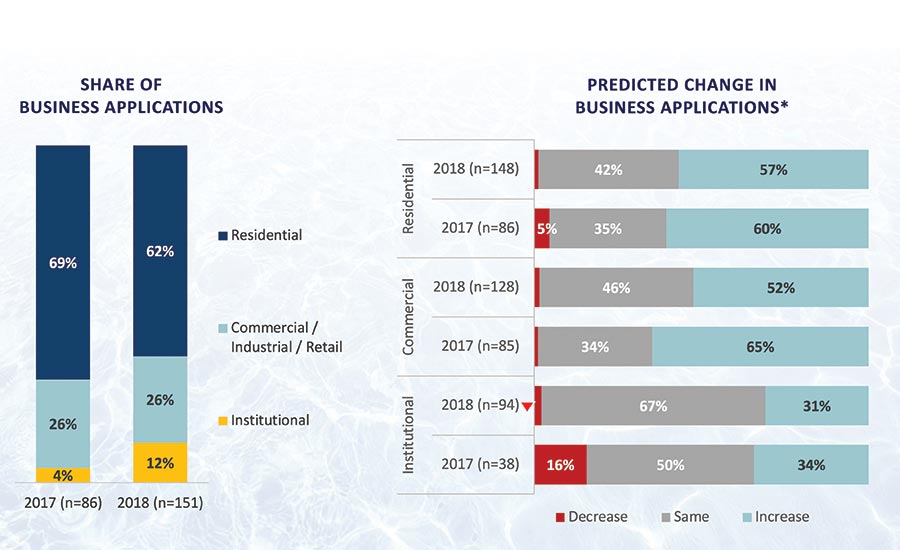

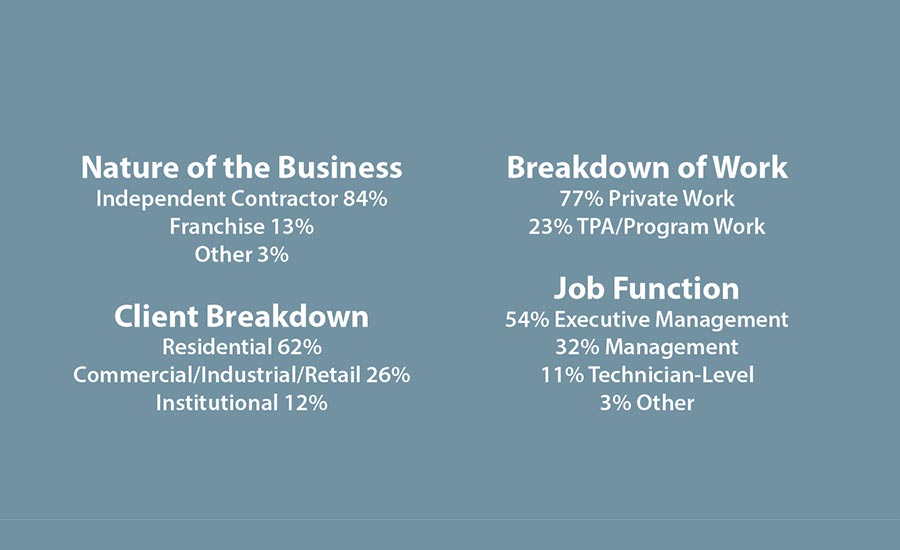

Several months ago, R&R did a study of its own specifically within the restoration industry. The purpose of the study was to better understand the overall state of the restoration/remediation industry, with a focus on current restoration companies, their business portfolios, expected changes in the next year, and other pertinent details. Companies were surveyed between July 16 and July 31, 2018. In all, 151 contractors across the U.S. responded, and the results are positive on the state and future outlook of the industry as a whole. Check out the sidebar to see the full breakdown on the next page of respondents.

Two-thirds of contractors said their revenues were up, and they expected them to continue trending upwards. Another 32 percent expected revenue to be the same; just 2 percent expected any sort of decrease in revenue. For the companies predicting an increase, they anticipated an average increase of 26 percent. While large-scale disasters like Hurricanes Florence and Michael, as well as the massive California wildfires, can certainly be credited for an uptick in work, it’s apparent a number of companies are taking advantage of passive revenue streams as well. This helps companies stay busy year-round and have a steadier and more consistent workflow.

New Revenue Sources

“Traditionally, the R&R industry has focused on curative services alone. By that, I mean when there’s a problem, our industry provides the solution. With that view, it’s easy to understand why most customers are considered once and done opportunities,” explained Mark Maier, the vice president of marketing and sales for the Enviroguard Division of Paradigm Labs. “The truth is that structures have consistent problems and 60 percent of all structures right now have some sort of moisture issue.”

According to Maier, Paradigm is seeing a trend with R&R companies that are further educating their customers and offering moisture control solutions, not just emergency restoration services. When looking at the big picture, some of the companies Maier spoke of had doubled their sales in the first six to 12 months; by year two, when it’s time for inspection renewals, they experienced another wave of revenue as well.

TOMI/SteraMist is another prime example of an industry service that works both during emergencies and throughout the year as a scheduled indoor air quality and disinfection service. While many contractors likely purchase the system for biohazard and disinfection services during illness outbreaks, it can also be used regularly for disinfecting schools, hospitals, and more.

Michael Pinto, president of Wonder Makers Environmental, credits some of the growth in the IAQ world to a society that is getting better at gathering and sharing information.

“From my vantage point, the big changes in IAQ in the next five to 10 years started several years ago,” he said. “While the profusion of information on the internet continues to drive decision making in the IAQ world, both good and bad, the slow but steady emergence of medical data to connect indoor environmental conditions to occupant health is a trend that will gather more momentum in the next few years.”

Some restoration companies are also expanding their service offerings to increase revenue, with forensic restoration being one of the niche services they now offer. Pete Duncanson, chairman of the board of directors for the IICRC, spoke about the importance of these services at R&R’s inaugural Preparing to Respond conference in October of this year.

“With the events of the past few years, like school shootings and the Las Vegas shooting, becoming more common and in the news, our industry is impacted,” Duncanson explained. “We have seen an expansion in calls for bio and trauma cleaning as the public’s awareness of potential dangers has increased. These losses are not all mass shootings; many are simple biohazard concerns in everyday locations.”

Accordingly, respondents to the State of the Industry study reported a 14 percent increase in the amount of drug residue removal products they are buying. About one in four contractors purchased those products in 2018, compared to just 13 percent one year prior.

With the adoption of new revenue sources comes the necessity to adopt new technology, of which there is no shortage.

Adopting New Technology

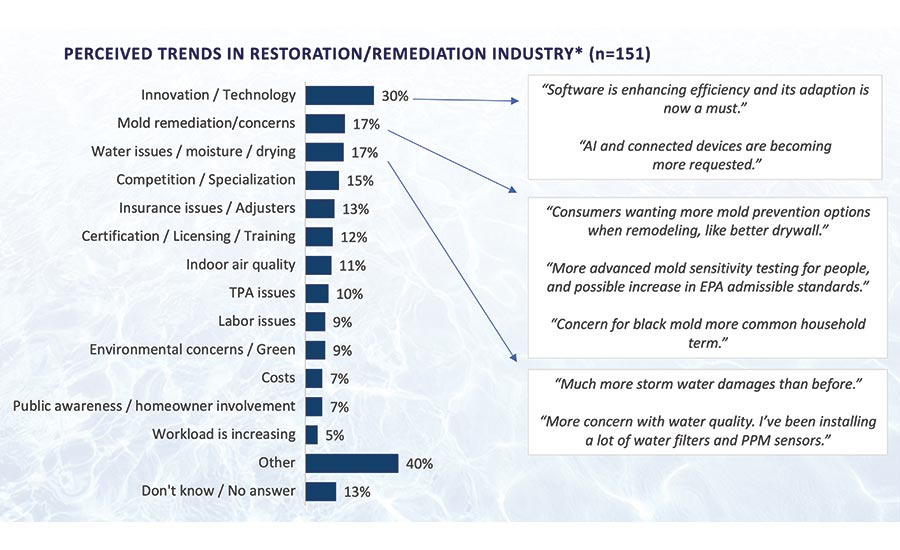

“Software is enhancing efficiency and its adaptation is now a must,” commented a respondent on this year’s study. When asked to list up to five current trends in the restoration industry, 30 percent of those surveyed cited innovations and technology.

Restoration contractors arguably have more choices when it comes to software than ever before. In early 2018, Next Gear Solutions once again made a move to create an all-in-one job management software solution by acquiring Moisture Mapper. However, there has been growth and increased visibility from other companies as well, like Encircle. As industry Facebook groups like Restoration Rebels and NORRP (National Organization of Restoration and Remediation Professionals) continue to be popular, there are often daily conversations about software options and opinions. The good news is some industry experts see the industry finally becoming more proactive with technology, instead of reactive.

“Adopting new technology is the driving force behind how the restoration industry will work collaboratively and effectively with other industries to achieve common goals,” explained Kris Rzesnoski, Encircle’s vice president of business development in a recent C&R article. “We have to face that our industry is changing for the better.”

When it comes to software, some talk of Xactimate is a must. Following the Restoration Industry Association’s TPA Conference in late 2017, there was an educational boom on creating more accurate scopes and how to affect price lists in your market. Ben Justesen, the owner of Just Right Cleaning & Construction (JRCC) in Washington State and founder of Enlightened Restoration Solutions, spent much of 2018 traversing the U.S. educating contractors on pricing.

“We need to be proactive about pricing and give Xactimate feedback,” Justesen explained during a presentation at the RIA Contents Summit in October. “We have this weird epidemic taking over called victimitis.”

Instead of blaming Xactimate for what contractors may view as inaccurate price lists, Justesen is re-educating contractors on how to stand their ground and give accurate feedback to Xactimate, which can greatly affect how much companies are paid for jobs. “Xactware is not the bad guy; it’s your ignorance.”

According to Justesen, overhead and profit (O&P) is not needed if you charge for true overhead and profit. Contractors need to look at their labor burden and labor overhead, and learn how to adjust pricing within Xactimate. To add credibility, Justesen suggests investing in Xactimate certifications and use that knowledge to educate, not to argue with adjusters and carriers.

Justesen, and many contractors across the country, have been able to positively affect labor rates and more by providing consistent, accurate pricing feedback.

There are several innovations that are helping contractors back up their scopes with visual evidence, like Matterport. This technology is much more than a 360-degree camera; it offers a 3D scan of a property, essentially allowing anyone viewing the property to do a virtual walkthrough and see even the most minute details. Matterport cameras have exploded in just two years, and are now being sought after and preferred by some insurance carriers and adjusters.

“Today, more than 300 restoration companies use Matterport cameras, and we are onboarding 50 or more every month,” said Tomer Poran, Matterport’s senior business development manager. “3D scans increase scope accuracy greatly, without having extra people on site since they can now view projects remotely.”

One of the biggest changes restoration companies are seeing is an increase in top-line revenue. Poran said these scans are preventing disputes between adjusters and contractors.

Likewise, more and more companies are purchasing and utilizing drones for exterior inspections. In fact, 28 percent of companies in our 2018 study say they plan to buy a drone in the next 12 months, compared to just 3 percent of respondents in 2017. About 20 percent of companies say they’re currently using a drone, while just 5 percent were utilizing this technology last year.

Tools of the Trade

Of course, technology isn’t the only area seeing some major evolution. Every day, routine tools like moisture meters, IR cameras, and even chemicals and cleaning solutions are evolving to meet restorer and consumer demands. One major demand in many markets today is for cleaner, safer solutions instead of the previously more harmful and toxic chemicals.

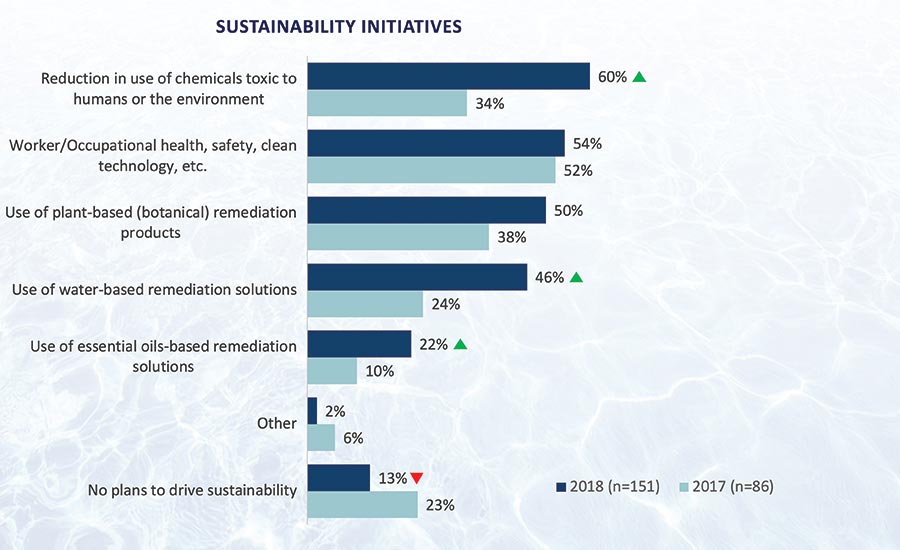

According to R&R’s 2018 State of the Industry study, 60 percent of contractors have already reduced, or continue to reduce, the use of toxic chemicals. Fifty percent plan to increase their use of plant-based and botanical remediation products. Just 13 percent had no plans to drive sustainability, which is down 10 percent from 2017.

When it comes to specific product and chemical usage, the use of preventative coatings and sealers is up about 20 percent from last year. On the flip side, the use of antimicrobials seems to be down about 15 percent. The use of disinfectants, deodorizers, mold stain removers, fungicides, smoke and soot removal products, and media blasting remained mostly unchanged.

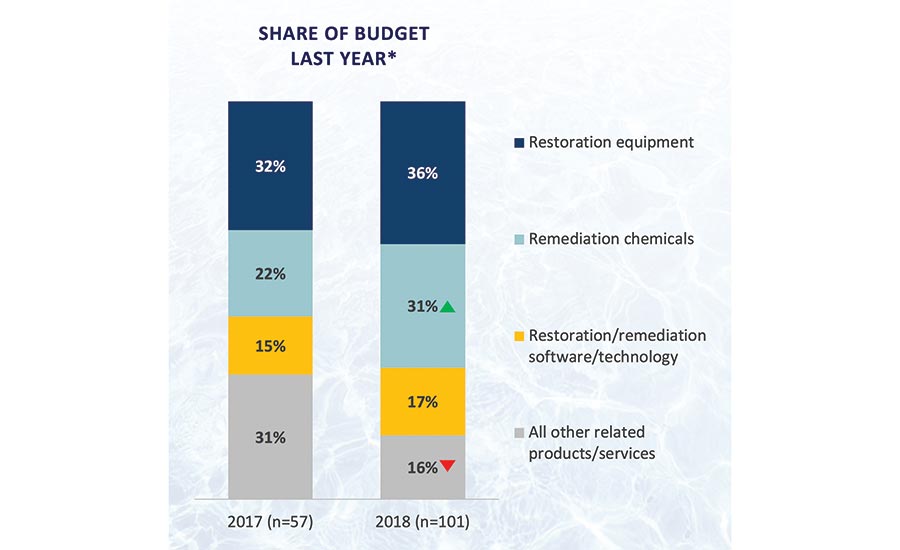

Diving deeper, about 31 percent of a restoration company’s budget this year will be spent on chemicals, meaning there is a massive market for botanical and “green” products. Of course, the greatest chunk of a company’s budget, about 36 percent, is being spent on equipment.

The good news here for local distributors and suppliers is that contractors still prefer purchasing from them instead of the big box stores. Forty-three percent of contractors said they purchase from their local guys, and another 22 percent say they buy from the manufacturer. The remaining 36 percent report making purchases from big box stores, Amazon, and other outlets.

Finding and Retaining Employees

Just like R&R’s State of the Industry study in 2017, contractors said finding skilled employees was their top challenge in 2018. However, the good news is there appears to have been a drop in concerns about retaining employees from last year. Hopefully that means companies are learning how to be more proactive in keeping their current employees happy and increasing wages as profits increase. After all, the last few years have definitely been a candidate’s market.

“Unemployment is at an all-time low right now. As long as the economy continues to be strong, we will be in a candidate’s market. We compare this to a seller’s market in real estate,” explained Kristy Sifford, owner of Wylander, a recruiting company that works specifically with restoration companies. “Buyers will pay more for a house than they would have a year ago. This theory applies to hiring. What you paid for an employee a year ago, in terms of base pay, has changed; you can expect to pay a higher base pay today than you would have for the same position a few years ago.”

Sifford said in today’s job market, many candidates are fielding offers from multiple companies and have their pick of where to go. One suggestion she has to keep your team fully staffed is to be recruiting all the time. If you find someone who would be a great fit for your team, but don’t have a position quite yet, don’t be afraid to approach them and have a conversation. Also, make it easy for candidates to apply and go through your interview process. You can stick with the old adage of “hire slow, fire fast”; however, there should never be a stall in a candidate’s hiring process. You need to keep things moving, and stay in communication with the candidate every step of the way.

For entry-level candidates, Sifford says it’s critical to create a succession plan. Positions like water techs usually have a high turnover rate, but if you give them a very clear picture of their career opportunities and earning potential, as well as goals to hit to keep moving up within the company, you’ll get greater buy-in from these employees.

The Industry Divide

Several years ago, Tim Hull, director of operations for Violand Management Associates, wrote an article about an industry divide. At the time, the shift pertained largely to companies choosing to do program work and be part of Third Party Administrator (TPA) networks, and companies choosing to do mainly or all private work. TPA’s have certainly been a hot topic in the industry in the last few years, even with the birth of Facebook groups dedicated to stepping away from the TPA model.

As the industry continues to grow, and there is more money to be made, Pinto pointed out that the divide between knowledgeable contractors who follow industry standards of care and “contractors” who provide quick, incorrect solutions is growing. This is further impacted by the shortage of qualified employees to do niche restoration and remediation work.

“The gap between the contractors that follow good work practices and those who focus on profits only by providing stop-gap solutions that do not involve real contaminant removal will continue to grow,” Pinto explained. He also noted that as specialization of restoration and remediation contractors continues to grow, those types of contractors are facing increased liability for the work they do.

Ross Driscoll Jr., vice president of National E&S Insurance Brokers and Driscoll & Driscoll, agrees with increased liability and insurance needs on multiple levels for contractors. While rates have been favorable, Driscoll noted that contractors are now needing to carry more insurance policies overall.

“Restoration contractors should not only be concerned about the insurance policies that are being required of them by the various TPA’s and franchisors, but look at some of the risks that they have internally,” Driscoll said. “I believe we will see an increase in the number of restoration contractors that will purchase Employment Practices Liability. Not only are a few of the well-known franchisors now requiring their members to carry it, but I would not be surprised if some of the TPA’s started to require it.”

EPL policies cover employers for things like sexual harassment, wrongful termination, discrimination, failure to promote, and so on.

Driscoll also noted an uptick in companies carrying coverage for employee theft. He said with companies performing so well in today’s market, it’s unfortunately easy for employers to lose sight of a key employee taking money, or items, so it’s important to evaluate your policies and your company’s needs often.

Employee Burnout

With the neck-breaking speed of the restoration world, and seasons of unparalleled busyness, employee burnout is also a very real and growing concern. In fact, it is so much of a concern that there is an academic study underway right now through Purdue and Middle Tennessee State University (MTSU) on that very topic.

Jake Avila grew up in the restoration world – part of a family-owned restoration company. Today, he is an associate professor of construction management at MTSU’s School of Concrete and Construction Management, and is helping spearhead the study on employee engagement and burnout. He hopes the study will contribute to our knowledge and understanding of the industry, and find solutions to address these challenges.

“With burnout, we hope to explore what restoration contractors can do to effectively recruit, train, and retain the right people,” Avila explained. “What we have learned so far has us very excited about our write-up and what the future will look like.”

The study’s survey period ended in mid-November; look for the results sometime in 2019.

Continued Adaptation

The rate at which restoration contractors are able to adapt to all the changes in our industry and technology will likely determine their success. There are many studies showing that our world today is changing at a pace that’s difficult, if not impossible, to match. Yet, through education and working together as an industry, it is possible. R&R hopes to continue being a trusted, valuable resource in the industry, and strives to share innovative and helpful information year-round.

This entire State of the Industry study is available for purchase at https://clearseasresearch.com.

Citations

The information contained within this article is comes from: Clear Seas Research. 2018 Restoration & Remediation CLEAReport. September 2018.

“Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinionPanel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com”

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!