The State of the Restoration Industry in 2019

A year of increased profits, new technology, and hiring woes.

See R&R's 2021 State of the Restoration Industry report

The numbers are pointing to this being a solid year for restoration and remodeling contractors. Despite new home construction being a bit sluggish, remodeling and maintenance spending grew as expected thanks largely to storms and continued recovery efforts from hurricanes in 2018. A study released by Harvard in June reported Americans spent $322 billion on remodeling and home repairs from July 2018 through June 2019; a 6.8% jump from the previous year. To further support projected growth, the National Association of Home Builders’ Remodeling Market Index rose one point to 55 in the second quarter of this year; being above 50 indicates most remodelers report market activity is higher compared to the previous quarter.

“The demand for remodeling continues to hold strong throughout the country. However, the lack of skilled labor continues to be one of the largest roadblocks in the industry.”

--Tim Ellis, National Association of Home Builders Chair

Monthly reports from BuildFax definitely support predictions of positive trends for restoration and remodeling so far. Every month, BuildFax (a Verisk company, which is also the parent company to Xactware) releases a Housing Health Report. Here is what their data has shown so far this year:

March: Home maintenance activity increased in hail and hurricane-impacted states, despite declines in other states.

April: Despite a slowdown in housing activity, hurricane recovery continued from 2018’s Irma and Michael, signaling insurance carriers to plan ahead for the 2019 hurricane season.

May: Again, despite the housing market still slowing a bit, many major metro areas saw remodeling activity increase.

June: Construction spending rose, even though home construction overall remained a bit sluggish.

July: Maintenance and remodeling spending both saw a year-over-year rise, likely the result of soaring roof maintenance activity.

August: While single-family housing authorizations declined for the third straight quarter, maintenance and remodeling volumes experienced a slow rise.

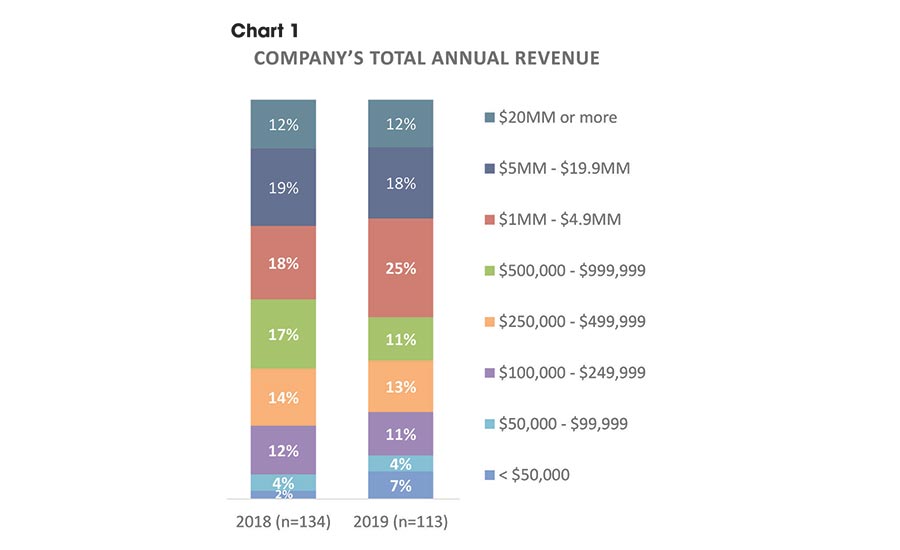

With all this data suggesting growth in the restoration and remodeling industries in many markets, we wanted to hear specifically from our readers. In the very latest research conducted by R&R and BNP Media’s Clear Seas Research this summer, 26% of restoration contractors predicted their business would increase this year. Only 5% predicted a decrease, meaning the rest predicted a year similar to the last.

Demographics

In all, 120 contractors weighed in for this year’s State of the Industry study. Of respondents, 75% were in upper management-level positions, with purchasing power. Eighty-four percent were from independent companies; 13% from franchise; the remaining 3% chose the “other” option.

Diving deeper, contractors noted that on average, 79% of the jobs they handle are private work, while 21% are through third-party administrators. That is a 2% rise in private work, and a subsequent drop in TPA work, from 2018.

One interesting note in the demographic information is companies are predicting less residential and institutional work and more commercial work in 2019 versus 2018. Even with this change, however, the amount of residential work year-over-year remains unchanged at 62%, with the real shifts happening between commercial and institutional.

Biggest Industry Challenges

Hiring & Retention

Looping back to all the data in the beginning about increased profits in 2019, three out of five contractors predicted an increase in revenue from restoration and remediation-type work – the same number as in 2018. As we all know, growth comes with challenges.

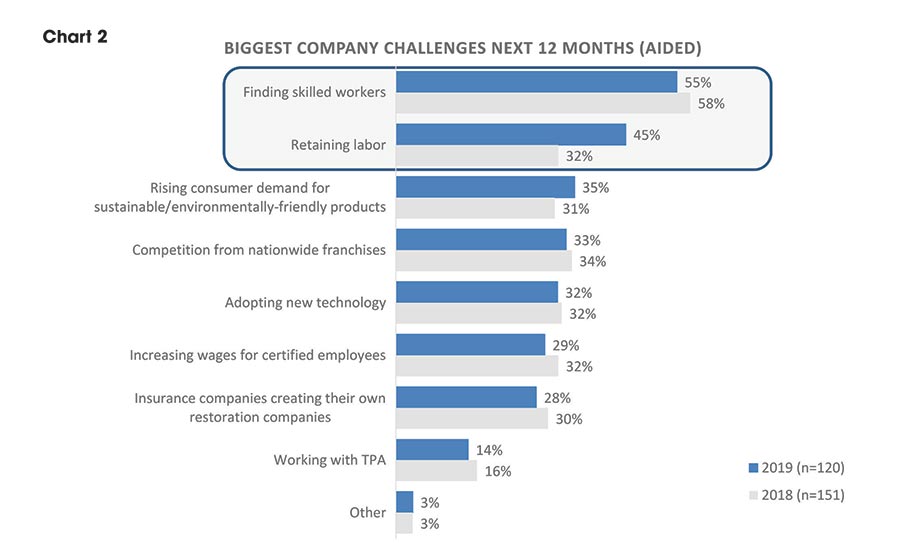

It’s likely unsurprising to most reading this article that the top industry pain points were finding skilled labor and retaining labor. The latter saw a significant jump in concern with 32% of contractors concerned about employee retention in 2018, and 45% concerned in 2019. With these two challenges being at the top, industry hiring and recruiting experts suggest changing up how hiring is done. This includes evaluating the interview process itself, and then what happens during onboarding of new hires.

“The biggest trend we are seeing right now are companies relying heavily on assessments to tell them whether they should hire a candidate or not. By thinking of these assessments as the silver bullet, we are losing the ability to effectively interview, asking the right questions of a candidate to see if they are a good fit,” explained Kristy Sifford, founder of Wylander, a recruiting company that specifically works with restoration contractors. “While we do believe in DISC, a personality profile, and use it as a hiring tool, it is not the final decision maker. Assessments are great, but are only one piece of the puzzle.”

Sifford further explains that she encounters many companies without an effective, planned out on-boarding process. With unemployment at an all-time low, she emphasizes that employers need to be reviewing on-boarding and training pieces within their company.

“With a solid on-boarding process and training plan, employees coming into our industry will be better prepared to serve customers,” she said. “New employees will decide to not stay with a new company without these pieces in place. We have seen it happen with a few of our clients.”

Chuck Violand, principal at Violand Management Associates, also noted the historically tight employment market as a major pain point for their clients and the restoration industry as a whole. Violand noted that fewer young workers entering into the trades will further exacerbate the shortage. This means it’s time for restoration contractors to get creative with how they find and retain talent within their organization, and also means looking outside the box for employees.

Adopting New Technology

This is a common pain point in the restoration industry. Typically, the industry is slightly behind on adoption compared to other industries. However, with restoration-specific software companies becoming more innovative, integrating more platforms, and becoming more user-friendly, we might be picking up speed. In both 2018 and 2019, 32% of contractors said adopting new technology is a challenge for them, and will continue to be over the next 12 months. A lot of this stress is likely coming from TPAs and carriers who are pushing for quicker handling and process of claims.

“A big trend this year is the shift to performance-based dispatch algorithms by a number of carriers. We see this trend picking up which means, more than ever, restorers will be judged not only on the quality of their work, but also by their data footprint,” explained Garret Gray, CEO of Next Gear Solutions. “Just because a program might not be fully deployed does not mean it won’t come and the data trail restorers leave today will affect the amount of work they get tomorrow.”

Gray emphasized that restorers need workflow automation and data visualization tools that “allow them to go paperless, real-time, and report on how they are living up to promised SLAs.” This means your entire team having up-to-date smartphones to send and receive data from jobsites.

“Many top restorers we work with are highly focused on winning the data war and even the best have learned it takes time to position a company to win,” Gray said. “The speed at which technology is changing is only increasing so getting caught up now is necessary for all restorers.”

It also can’t be overlooked when talking about technology that there has been light speed adoption of 3D cameras in the restoration industry in the last year or two. This is increasing both the accuracy and efficiency of estimates and scopes of work, and in turn helping restoration contractors have evidence to support their invoices to adjusters and carriers.

“With the Matterport 3D models, we can produce an estimate more efficiently, and as a result, sign customers faster,” said Josh Hobbs in a recent R&R article. “By sharing the Matterport 3D models with stakeholders, we’ve reduced the number of inquiries and disputes from insurance adjusters, building consultants, and owners. The 3D model provides everyone with a single, accurate source of documentation to reference throughout the restoration and claims processes, helping us serve more customers, faster.”

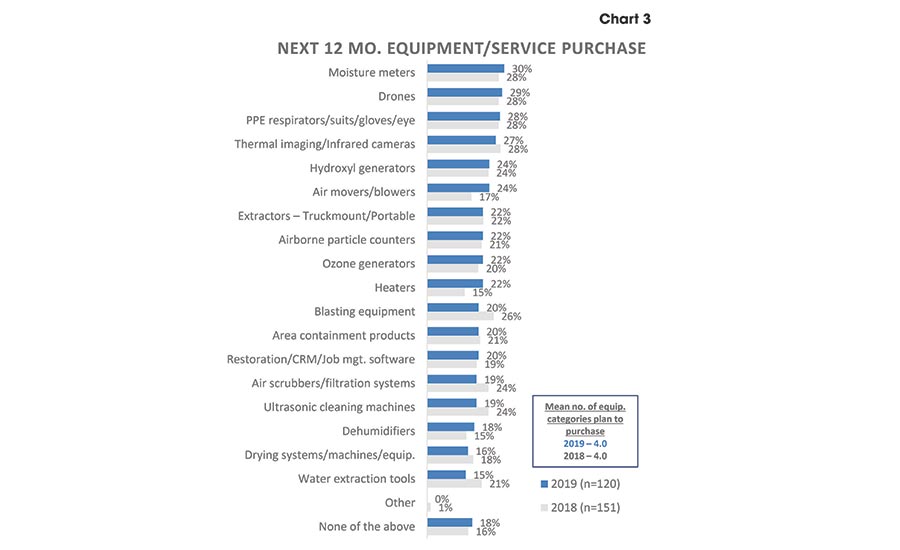

Drones also remain a hot new tool for restorers. In our study, 29% of contractors plan to purchase a drone in the next 12 months. This was the second most anticipated purchase, second only to moisture meters – of which 30% of contractors plan to buy. PPE equipment, since it needs to be replaced often, came in as the third most anticipated purchase over the next year (Chart 3).

Mergers and Acquisitions

This year has seen a lot of industry-related mergers and acquisitions. Here are some acquisitions that made headlines:

- Verisk acquired BuildFax (October)

- Next Gear acquired Accurence (August)

- J.S. Held acquired Welinger & Associates (August)

- Interstate Restoration acquired ASR Property Restoration (July)

- FirstService Corporation acquired Mammoth Restoration (June)

- FirstService Corporation acquired Interstate and FirstOnSite (May)

- American Securities acquired BELFOR (April)

- J.S. Held acquired Veritox Inc. & GT Engineering (April)

- SERVPRO acquired by Blackstone (March)

- Jon-Don acquired Quest Building Products (February)

- AdvantaClean acquired by Home Franchise Concepts (January)

- Throughout 2019, Aramsco acquired: Horny Toad Tools, Routley Enterprises, Wolf Cleaning Equipment and Supply

Phew! With that many changes for major industry players in just one calendar year, there are bound to be more changes down the road for the rest of the industry.

“The prevalence of mergers and acquisitions among large regional and national restoration contractors, especially with the introduction of private equity funding, will have a significant impact on the industry,” Violand said. “This will necessitate all restorers, especially independent operators, to manage their businesses with the rigor and discipline needed to sustain profitable growth.”

Michael Pinto, owner of Wonder Makers Environmental, echoed the same sentiments noting national companies and franchises are expanding, which is “being driven by the demand of insurance companies and commercial businesses to utilize restoration contractors that have a regional presence at a minimum, if not national.”

Other Stats to Note

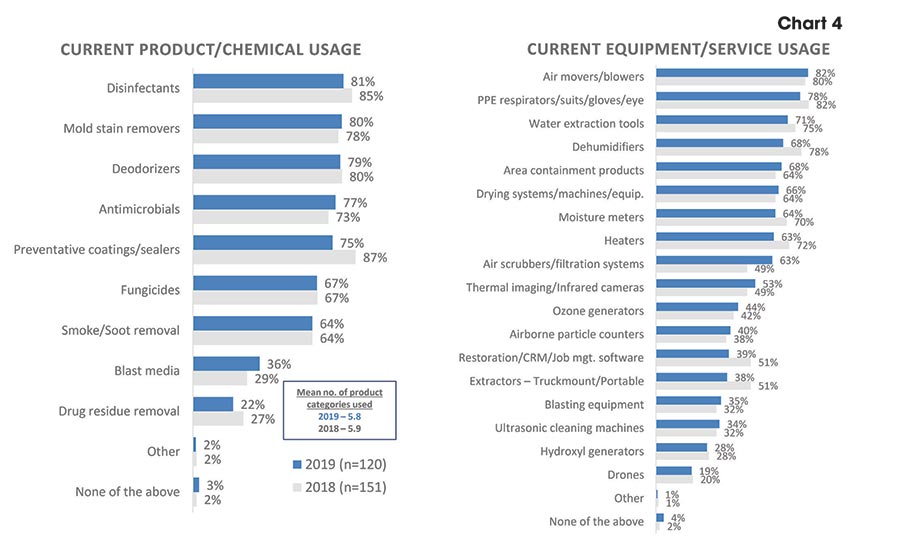

Like in 2018, a number of restoration companies plan to drive sustainability initiatives this year – with 64% of companies looking to reduce using toxic chemicals, and 48% using botanical remediation products.

While overall chemical usage remained pretty similar year over year, there was one downward trend seen with the use of preventative coatings and sealers, usually utilized during fire damage restoration jobs. Last year, 87% of contractors reported using those products, compared to 75% this year (Chart 4). Also on a similar note, there was a 13% decrease in the use of truckmount and portable extractors year over year, but an increase of 14% in the usage of air scrubbers and filtration systems. As contractors become more educated on mold, and the ability for particles to so easily cross-contaminate a job site, many restorers seem to be doubling down on their containment efforts.

This year’s research also held some good news for local distributors and suppliers – with contractors making 40% of their purchases from those vendors. Twenty-four percent of purchases are coming from big box stores like Home Depot and Lowe’s, up just 2% from last year, and purchases from Amazon specifically remained the same from 2018 to 2019 at 22%.

On one final note, when it comes to storm work, 39% of contractors said they do travel, or will travel, for large scale disaster work. That’s up from 32% of contractors who gave us feedback in the summer of 2018, before hurricanes Irma and Michael hit.

Looking Ahead

The future generation of restorers is here, and already leaving their mark through groups like The Alliance of Independent Restorers (formerly the Restoration Rebels) and The National Organization of Restoration and Remediation Professionals (NOORP). These groups are gaining more credibility and notice from longer standing, foundational organizations like the Restoration Industry Association. As leadership from one generation to the next continues to shift, more change is on the horizon for restorers.

“Younger restorers who are technically savvy, innovative, impatient, and not afraid of disrupting the status-quo represent a growing component of the industry,” Violand said.

We want YOUR take on what’s happening in the industry! Comment below this article on our website or Facebook page and get involved in the conversation!

“Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com”

To learn more about the report and purchase, visit https://clearseasresearch.com/product/2019-restoration-and-remediation/?r=16

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!