Factor Your Insurance Burden into Your Restoration Estimates

Photo: FG Trade / E+ via Getty Images

In the restoration industry today, most will agree that making a profit is getting more and more difficult, especially if you specialize in structural repair or restoration. Now, more than ever, the role of the estimator has become the linchpin of restoration projects that ultimately determines whether a company will survive and prosper or do little more than turn dollars over.

Seasoned estimators shouldn’t miss much when it comes to scoping visible damages, such as drywall, cabinets, flooring, and paint. However, most estimators rarely take into account other expenses that are not necessarily damage related, but still part of the overall project cost. One expense in particular is the cost of insurance, especially insurances that base their premiums on gross sales.

Typically, there are two categories of insurance policies that restoration companies purchase. One covers operational insurances such as auto liability, employers’ liability, commercial or business property insurance, or business interruption insurance. The costs of insurances like these are typically considered to be part of a company’s overhead. The other category covers risks and liability associated with services provided and/or work performed. These costs are considered to be hard costs associated with contracted work.

These include but are not limited to:

- Contractors General Liability Insurance

- Completed Operations Insurance

- Errors & Omissions Insurance (professional liability)

- Contractors Pollution Liability Insurance

- Contractors Umbrella Insurance

- Inland Marine Insurance

Most, if not all of these policies rate their premiums (at least in part) to annual gross sales. There are a number of factors that insurance companies use to calculate risk and premiums and here are a few:

Gross sales

Typically, the more money you earn as a company, the higher your premium. Most liability policy premiums are calculated on a percentage of your gross sales. For example, if you are a low-risk contractor with no prior claims history and had $3 million dollars in sales, your general liability insurer may charge 1% or $30,000. If your company is a higher risk, this premium could jump to 3% or more. If your company carries policies other than general liability, such as those mentioned above, your total premium percentage for all your policies could be 5% or more.

Loss or claims history

If you’ve made claims on your general liability insurance, it’s a sign to an insurer that you’re a high risk and likely to file more claims in the future. If you’ve filed claims in the past 5 years, you can expect to pay significantly higher premiums than companies that haven’t had any claims.

The type of services you offer

If you are a full-service restoration company that does complete reconstruction, including work on condominiums, and hazardous material abatement, you will most likely be at a greater risk of lawsuits and accidents than a company that only does packouts or water mitigation. Restoration companies that engage in reconstruction always run a higher risk of construction defects and lawsuits that can drive insurance premiums up.

Experience

Insurance companies are leery of restoration companies and/or their principals that don’t have a lot of experience in the trades. Companies that are relatively new to the industry present a far greater risk and liability than those who have been around a long time and haven’t had a claim. Your business's longevity and financial stability can affect your premiums.

Policy limits

The amount of coverage you need will be a factor in the premium, especially if you need more than the standard limits offered other companies in your field.

Deductibles

Oftentimes a higher deductible can lower premiums. Some restorers self-insure to a certain degree to avoid filing claims on small losses that can result in higher premiums or being denied insurance altogether.

Credit score

Credit scores are considered to be a measure of how reliable a policyholder will be in paying their insurance premiums. If you have a low credit score, you will likely pay more for insurance because you’re viewed as a bigger risk.

Location of the business

Some cities and states are known for their high rates of lawsuits and criminal activity. If your business is located in one of them, you are likely going to pay more for insurance.

Charge for your insurance burden as a direct job cost

If you are engaged in restoration work, especially reconstruction where your insurance premiums are based on your gross annual sales, then the cost of those policies should be passed on to every project. Not every contractor has the same insurance burden and the annual cost can go up or down depending on your claim history and risk. Keep in mind that 10% commonly used to cover overhead in estimates is supposed to cover the company’s operating expenses, not expenses attributed to any given project. Seeing as certain types of insurance policies base their premiums on the dollar amount of the work you engage in, the cost is no different than charging for supervision, labor, or materials.

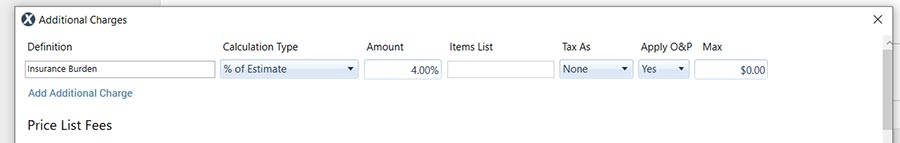

In order to calculate the cost of your insurance burden, you will first need to figure out what insurance policies you have that base their premiums off of your gross sales. Then you’ll need to calculate what the premium percentage will be and factor the cost into your estimates. If your company carries insurance policies associated with risks associated with your work that cost a combined premium of 4% of your gross sales, then you should factor 4% in your estimates to cover the cost. If you are using Xactimate, this can be done by adding an “Additional Charge” on the “Claim Info” page within a project. On the “Parameters” page, click “Additional Charges”.

Then select the “Definition” as Insurance Burden, then select “Calculation Type” as (% of Estimate) and 4%. This will then calculate the insurance percentage as a dollar figure at the end of your estimate on the summary page.

Including your insurance burden in your estimates is one effective way to recover costs and increase your profit margin. Taking the time to calculate your annual premiums that are based on sales and explain this burden to your clients will help them understand that this is a legitimate job cost.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!