ABC’s Construction Backlog Slips in March; Contractor Optimism Continues to Improve

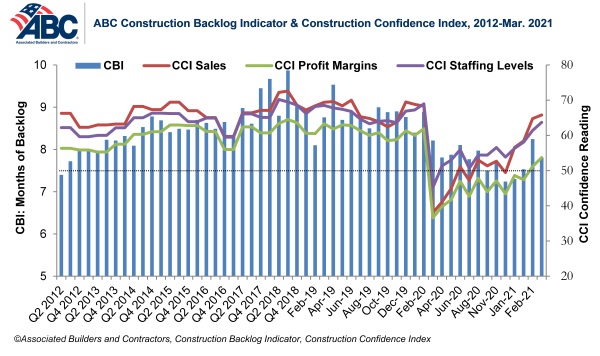

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 7.8 months in March, according to an ABC member survey conducted from March 22 to April 5, a decrease of 0.4 months from both the February 2021 and March 2020 readings.

Construction Backlog Indicator

| March 2021 | Feb. 2021 | March 2020 | 1-Month Net Change | 12-Month Net Change | |

| Total | 7.8 | 8.2 | 8.2 | -0.4 | -0.4 |

| Industry | |||||

| Commercial & Institutional | 7.77 | 8.3 | 8.6 | -0.6 | -.09 |

| Heavy Industrial | 8.5 | 6.5 | 5.2 | 2.0 | 3.3 |

| Infrastructure | 8.3 | 9.1 | 8.9 | -0.8 | -0.6 |

| Region | |||||

| Middle States | 7.3 | 7.6 | 7.3 | -0.3 | 0.0 |

| Northeast | 8.1 | 8.6 | 7.6 | -0.5 | 0.5 |

| South | 8.3 | 8.0 | 9.7 | 0.3 | -1.4 |

| West | 7.4 | 9.3 | 7.8 | -1.9 | -0.4 |

| Company Size | |||||

| <$30 Million | 7.5 | 7.7 | 8.1 | -0.2 | -0.6 |

| $30-$50 Million | 7.9 | 6.9 | 7.0 | 1.0 | 0.9 |

| $50-$100 Million | 8.4 | 8.8 | 7.8 | -0.4 | 0.6 |

| >$100 Million | 10.4 | 12.0 | 11.5 | -1.6 | -1.1 |

©Associated Builders and Contractors, Construction Backlog Indicator

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in March. All three indices remain above the threshold of 50, indicating expectations of growth over the next six months.

Construction Confidence Index

| Response | March 2021 | February 2021 | March 2020 | ||

| CCI Reading | |||||

| Sales | 65.8 | 64.8 | 38.1 | ||

| Profit Margins | 53.7 | 51.2 | 36.6 | ||

| Staffing | 63.7 | 61.4 | 45.2 | ||

| Sales Expectations | |||||

| Up Big | 13.8% | 11.1% | 4.7% | ||

| Up Small | 55.2% | 56.7% | 24.5% | ||

| No Change | 14.4% | 15.8% | 14.1% | ||

| Down Small | 13.5% | 12.9% | 31.8% | ||

| Down Big | 3.1% | 3.5% | 24.9% | ||

| Profit Margins Expectations | |||||

| Up Big | 4.3% | 2.3% | 2.9% | ||

| Up Small | 36.8% | 33.3% | 16.6% | ||

| No Change | 32.2% | 36.8% | 25.3% | ||

| Down Small | 22.7% | 21.6% | 34.3% | ||

| Down Big | 4.0% | 5.8% | 20.9% | ||

| Staffing Level Expectations | |||||

| Up Big | 7.1% | 3.5% | 3.2% | ||

| Up Small | 49.7% | 49.1% | 27.4% | ||

| No Change | 35.0% | 38.6% | 31.0% | ||

| Down Small | 7.4% | 7.0% | 23.5% | ||

| Down Big | 0.9% | 1.8% | 14.8% | ||

©Associated Builders and Contractors, Construction Confidence Index

“There are two countervailing forces influencing backlog,” said Basu. “On the one hand, design work on new projects declined during most of the pandemic. Some of this is attributable to the need to socially distance, risk aversion and the jarring effects of the crisis on commercial real estate. The result has been fewer projects presently available for bid, which is consistent with declining backlog.

“On the other hand, the surprisingly strong economic recovery has brought projects that seemed dead back to life,” said Basu. “The boom in e-commerce and other tech segments has also produced greater levels of demand for construction of fulfillment and data centers. The overall result is that backlog is roughly where it was six months ago. Given that contractors remain confident regarding sales, employment and profit margins over the balance of the year, the expectation is that more projects will enter the design phase, bidding opportunities are set to rise and at some point backlog will reestablish an upward trajectory.”

Click here for a short video from ABC’s chief economist to see what the latest survey data mean for the construction industry.

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Click here for historical CCI and CBI data and here for methodology. Visit abc.org/economics for the CBI and CCI reports, plus analysis of spending, employment, GDP and the Producer Price Index.

Associated Builders and Contractors is a national construction industry trade association established in 1950 that represents more than 21,000 members. Founded on the merit shop philosophy, ABC and its 69 chapters help members develop people, win work and deliver that work safely, ethically and profitably for the betterment of the communities in which ABC and its members work. Visit us at abc.org.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!