The Insurance Business and You: Finding Coverage in the COVID-19 Era

No industry is more affected by trends in the insurance business than a restoration firm. Insurance companies provide both a source of revenue to restoration firms in the form of claims payments and the insurance that enables companies to stay in business.

Now, insurance companies are feeling the stress of coronavirus and that is trickling down to restorers. Insurance companies are being stressed in a number of ways including historically poor underwriting profitability in the restoration class of business, poor returns on their investments, and the anticipated and unanticipated effects of coronavirus.

When insurance companies become stressed, the effects are quickly felt in restoration. Below, I will detail some of the way’s restorers will be impacted by insurance company operations now and into 2021.

I will also offer some tips on how to deal with these changes.

Insurance is essential, but getting tougher to find for restorers.

If a restoration firm becomes uninsurable, it is a game over scenario; commercial customers will not hire the firm and bankers will not lend. In the past six months, I have seen an increasing number of restorers dangerously close to becoming uninsurable at any price.

Some restoration firms, usually as a direct result of an insurance agent’s bungling of the insurance application process, are getting down to only one insurance company being willing to insure them. In those “dangerously close to game over” scenarios, I suspect the restorers had no idea how close they came to closing their doors due to the inability to buy insurance at any price.

There are about one thousand insurance companies insuring businesses in the U.S. There are only five that do a good job insuring restoration firms with policies that actually meet common insurance requirements in master restoration services contracts with insurance companies. In case you’ve not heard me say it in every past article I’ve written for R&R in recent history, at least 90% of the insurance policies sold to restoration companies do not meet the insurance specifications of the leading direct repair networks. Insurance agents issue certificates of insurance representing total compliance with the insurance specifications. From the direct repair network’s perspective, they are holding an unlimited obligation from the restorer to make good on anything insurance does not cover. Plus, the direct repair networks have the insurance agent on the hook for a bogus insurance certificate if the contractor runs out of personal funds to back up the indemnity obligations the direct repair networks all have. Obviously not a good situation to be in for the contractors.

It is not easy to find functional insurance for a restoration firm. Eighty percent of the insurance companies targeting restoration firms as desirable business five years ago are no longer offering policies to restorers today. That insurance market exit was in play long before COVID-19 and is being made worse by the coronavirus.

You should be selecting your insurance company, not the insurance company selecting you.

A specialized insurance broker should be able to tell you the top insurance company matches for your business. They should also be able to get you into the insurance company of your choosing. The key to getting that done is to select the insurance agent and wholesale broker based on their expertise in your business and keeping controls on both. Ask: “who are you sending my insurance application to and why?” There are well-qualified retail insurance agencies and wholesale insurance brokers serving restoration firms; they do not blanket the marketplace with applications. There is no upside to you by having insurance agents sending insurance applications to underwriters who are going to decline your account anyway. All that activity does is trash your firm’s reputation with underwriters. Blanketing the insurance marketplace with insurance applications is happening more due to the turmoil COVID-19 has created for insurance companies.

Get an affirmative coverage grant for virus as a cause of loss.

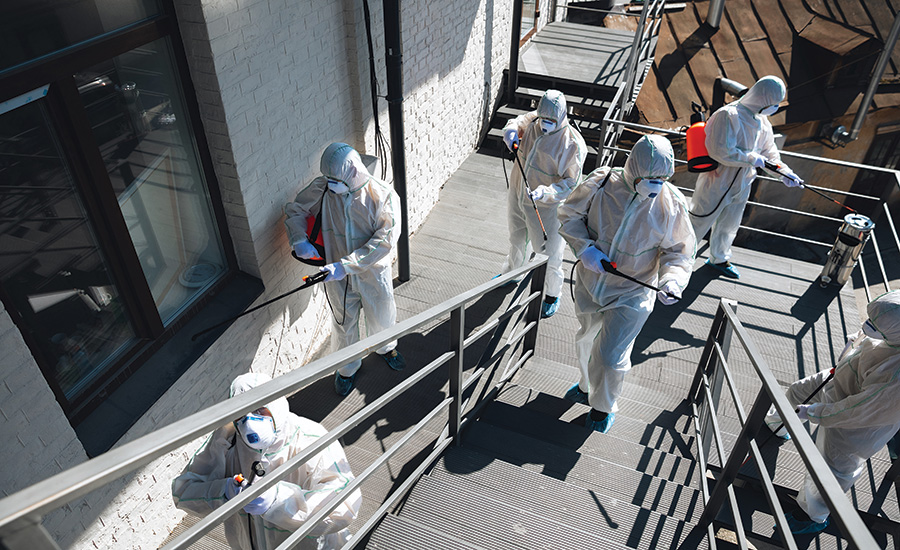

In March, the emergence of the coronavirus risk created upheaval with insurance underwriters. In my conversations with the claims departments at the leading insurance companies insuring restoration firms, I was told they intended to deny all claims arising from any coronavirus decontamination services, because performing those services was not what the underwriter signed up to cover when the policy was sold. Virtually every insurance company I spoke with was saying the same thing on March 12th. Fortunately, that conversation has toned down some.

As I was being told by the insurance companies they were planning to cut and run from coronavirus losses, some insurance brokers promoted the concept that the coronavirus risk was no different than other biohazard remediations. Except for the deaths from COVID-19, that is pretty much right. Therefore, restorers would not need to amend their insurance coverage at all. That advice directly conflicted with what I was routinely being told by the underwriting and claims departments of insurance companies that insured restorers. Insurance brokers are not employees of insurance companies and do not speak for the insurance company itself. I would put my money on the insurance carrier not the broker.

I found it interesting that one insurance company that was promoted by insurance brokers as fully covering COVID-19 risk with no needed amendments to the policy took a full six months to develop an endorsement to the policy that provided an affirmative coverage grant for virus decontamination services. If no change in the policy was needed to get coverage for virus decontamination services, why did it take six months to get an affirmative grant of coverage approved by the top brass of the insurance company? I find that situation between the insurance company and brokers selling their policies suspicious, with contractors stuck in the middle. My advice to the firms working with biohazards is to get an affirmative coverage grant for virus as a covered cause of loss, before you actually need to make a claim.

The affirmative coverage grant is less important if the policy form already covers viruses as a defined “pollutant” and the policy has been written based on an application for insurance that discloses virus decontamination services.

Universal communicable disease exclusions.

Today, insurance companies are adding communicable disease exclusions into property and liability insurance policies. In essence, these exclusions eliminate coverage for losses associated with a transmitted disease. With the exception of insured coronavirus decontamination service providers, virtually everyone is uninsured for losses associated with coronavirus. Contractors beware, a contractors pollution liability policy with a communicable disease exclusion will not work for virus as a cause of loss. COVID-19 is a communicable disease.

Getting paid for virus disinfecting work is not business as usual.

For restorers accustomed to being paid by insurance proceeds, that will not be the case for virus decontamination services in the short term. Specialized environmental insurance policies are being developed for building owners to pay for virus decontamination services, but as of this writing in September of 2020, those policies are not available for purchase.

A design feature of at least one of those environmental insurance policies for property owners is that the insured property must have an Emergency Response Plan for water intrusion and biohazard disinfecting services. Property owners seeking to insure biohazard risks are going to need preplaced drying and biohazard cleaning services. There is a marketing tip for innovative restoration firms. There will be a new source driving demand for those preplaced servicing agreements: the availability of biohazard environmental insurance on the property.

Avoid being an easy target for liability lawsuits.

Utilizing chemicals for unapproved purposes, either by the manufacturer or by the EPA, sets you up as an easy target for negligence-based lawsuits. The application of biocides without a license where one is required is illegal and insurance companies do not pay for illegal services rendered.

Barry Costa has spent many months researching the need for a special license in all states and territories. For information on the need for licenses by state, he can be reached at barry@costagroupeducation.com.

Warranties are not covered by insurance.

Avoid promises that you can make a building free from virus contamination for any length of time. I cannot find any credible testing of a material outside of laboratory conditions that proves a disinfectant is effective after the cleaning firm leaves the premises.

The manufacturers of the products used to disinfect buildings are also being forced to accept communicable diseases exclusions on their liability insurance policies when those policies are renewed.

A firm providing a warranty for a long-term kill for virus has got some potential liability issues to deal with. Warranties are not insured on the contractor’s liability policies. The manufacturer of the materials used to provide the “90 day kill of the coronavirus” is also likely uninsured. Today, the building owner is uninsured for losses associated with coronavirus. That leaves the pocket book of the firm granting a warranty as the only source of funds to back the warranty.

Now more than ever, restoration contractors need to be paying attention to their insurance relationships and getting insured for what you do for a living. The good news is coverage is available and prices are still affordable.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!