Latest Housing Health Report Shows Home Maintenance Increase for Second Straight Month

The BuildFax Housing Health Report revealed that single-family housing authorizations, a key indicator of historic recessions, decreased 1.06% from July to August 2019 and 4.17% year over year, rounding out the third straight quarter of declines this year. After a period of steep drops in annual new construction activity that began last December, the rate of declines for single-family housing authorizations has slowed in recent months.

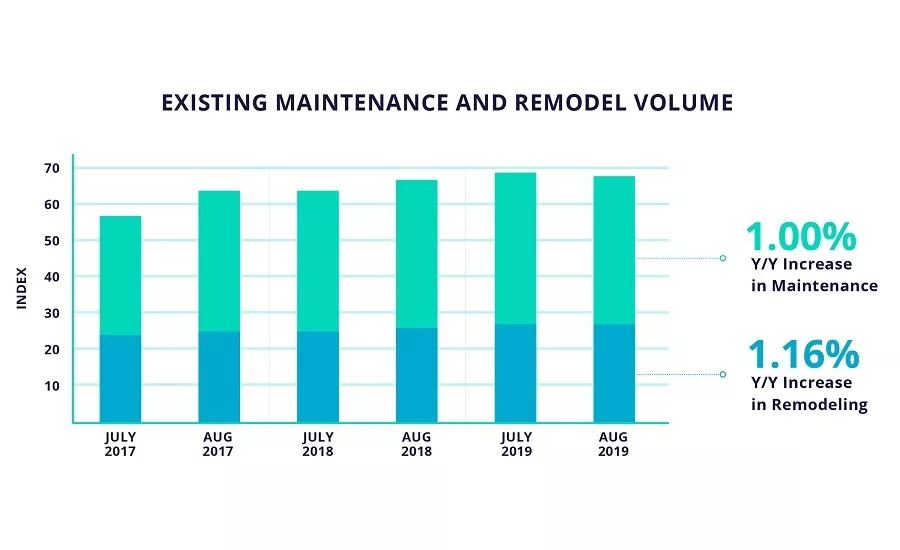

Nonetheless, these declines are causing a ripple-effect in other areas of the housing sector. For instance, the decreased housing supply and consumer hesitation in a tumultuous market has already begun to shift the sector towards a buyer’s market. Conversely, maintenance activity for existing homes, which is closely correlated to consumer confidence, increased for two consecutive months. This suggests a potential stabilization of this indicator.

Housing Supply by Volume

- Single-family housing authorizations declined 4.17% year over year.

- Existing housing maintenance volume increased by 1.00% year over year.

- Existing housing remodel volume increased by 1.16% year over year.

“As declines across key economic indicators hint at an economic slump, talk of a potential recession has amplified. It’s difficult to definitively say whether one is imminent. However, heightened tensions surrounding a probable recession has put increased scrutiny on the declining single-family housing authorization index, which has a high correlation to historical recessions,” says BuildFax CEO Holly Tachovsky. “The potential shift in residential housing towards a buyer’s market is one example of the market reacting in a tangible way to these declines.”

“On the other hand, existing housing maintenance – a gauge of consumer confidence – is now rising. This suggests that U.S. homeowners have enough confidence in the market to embark on substantial property updates,” says Tachovsky. “This is good to see, especially amidst this year’s severe weather events, as maintenance activity improves the residential housing stock – an asset class that’s valued at more than $35 trillion.”

Maintenance Spotlight: Hurricane Dorian Hits Weather-Worn North Carolina

As conversations around a future recession gain momentum, it’s important to monitor maintenance activity in the U.S. housing stock as an indicator of consumer confidence. This is particularly true for areas like North Carolina, which has been hit with severe convective storms and two major hurricanes in the last two years, putting a strain on homeowners and insurance carriers who bear the financial burden that these disasters put on properties. In fact, BuildFax data shows the state responded with accelerated maintenance activity. For instance, maintenance activity in the state jumped 34.84% in the month following Florence.

For more trends affecting the U.S. housing market, access the full report here. To learn more about BuildFax, visit www.buildfax.com.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!