Roofing: A New Opportunity for Professional Restorers?

The demand for self performed roofing is being driven by basically two factors

Looking for a new source of revenue in your restoration business?

Consider going into the self-performed roofing business.

But you start, you need to get things planned out or you could be stepping into a money pit trap.

The demand for self performed roofing is being driven by basically two factors:

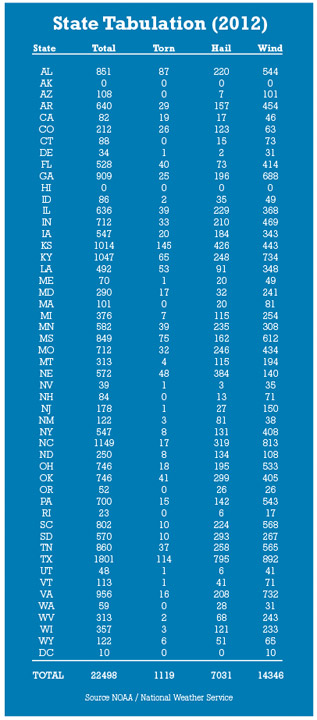

- The increase in the frequency and severity of hail and wind damage claims and,

- The traditional residential roofing business model does not fit the total customer experience business strategies of the leading homeowners insurance companies.

These two factors are game changers in the roofing business. Neither driver is likely to change within any relevant time frame.

According the NASA, “climate change may not be responsible for the recent skyrocketing cost of natural disasters, but it is very likely that it will impact future catastrophes.” The literature on climate change consistently predicts more intense storms with more water content in them. Combining that factor with increasing populations in areas that are more prone to adverse weather events and the basic demand drivers for new roofs paid for by insurance companies are easy to understand.

The insurance industry trade press is full of articles on the increasing rate and cost of weather related losses. Global warming is creating a lot more hail storms every year. According to The National Underwriter, hail usually causes an average of $1 billion in insured damage to crops and property each year. However a recent hailstorm in north Texas is quickly approaching half that amount just on its own.

Only if the insurance companies got out of the business of insuring damages to roofs would the bottom fall out of demand for new roofs in the restoration business. This is not likely to happen. The insurance business is pretty simple in concept. Insurance companies collect relatively small amounts of money from a lot of customers to pay claims to a few customers. As long as the insurance companies get more money in the front door than they need to pay for the claims going out the back door, life is good at the insurance company. Since insurance companies essentially make money on the difference between premiums collected and claims paid, the more claims they can cover, the more money they make. Therefore it is very unlikely that insurance companies will stop insuring roofs for their replacement costs.

Why the recent focus on roofing in the restoration business? The demand for self-performed roofing capabilities from professional restorers mirrors the drivers in the growth of the restoration networks. The Internet makes variation in their customer’s claims experience less and less tolerable for homeowner’s insurance companies, which is fueling the growth in restoration networks. Among the top value propositions in a restoration network are contractors with a known ability to:

- Do high quality work,

- Employ people who have undergone a background check,

- Maintain high-quality liability insurance, which has been verified by the network staff,

- Indemnify the network and sometimes the insurance companies for the damages that the contractor may cause on the job.

Looking at this list, a truckload of undocumented workers showing up to slap on a roof for a homeowner who has been handed a claim check by their insurance company would be the exact opposite of where the insurance companies are headed in the use of contactor networks.

The combination of insurance companies paying for a good percentage of all the new roofs in America, combined with need for a great customer claims experience is certain to revolutionize the residential roofing industry in parts of the country with severe weather events. No longer will restoration firms have to compete with the storm chasing truck full of undocumented workers for the roofing job, the job will be assigned to the approved contractor under a master services agreement. It is a whole new game in residential roofing and a great opportunity to expand the services and revenues of a restoration firm in high hail and wind risk states.

But there is a catch.

Roofers face a super tough insurance marketplace. If you open a roofing division, be prepared to tackle the constraints in the insurance market place that roofers face. If your restoration firm is classified on your General Liability (GL) insurance policy as “Carpet Cleaning” or “Janitorial,” which is actually common, you can expect your insurance to be canceled or non-renewed if you go into roofing services. I once had a senior executive of a multi-billion dollar insurance company that had a major construction division tell me that, as far as she was concerned, all roofers were an awful risk and some were worse than others. Of course she was thinking of the truck full of undocumented workers business model. But that business model legacy lives on in the minds of insurance underwriters. Any restoration firm opening a roofing division needs to prepare for the hostile insurance underwriting reception they are likely to receive.

Before you open a roofing operation you need to plan on the changes in your insurance program. I do not to want to leave the impression that things are hopeless on getting insurance on a restoration firm offering roofing services - that is far from the reality. The fact that you are a qualified restoration firm first opens doors for business insurance coverage that would otherwise be closed. There are a very limited number of insurance companies that will insure a restoration firm that has a roofing operation with liability policies that actually meet the insurance requirements of the networks. Another insurance market constraint is the insurance companies that insure roofers as a specialty generally will not insure “restoration contractors.” So how do you get around the Catch 22?

First, before you open a self-performed roofing division, make sure your insurance coverage can accommodate the new roofing operation with insurance policies that actually meet the insurance specifications of the networks who will be sending you the jobs. If you are a properly insured restoration firm, there is a good chance you can slide a restoration roofing operation in under the current coverage with very little hassle. However, if your GL policy has you only rated as a janitor or cleaner, be prepared for a wild insurance ride as your underwriter reaches the conclusion that you actually are a real contractor. In those cases I would expect the Workers Compensation insurance to be canceled or non-renewed as well as the GL. Bottom line on that is you likely needed to get out of that policy anyway. You were a contractor before you considered doing roofing.

You never want to have your insurance canceled or non- renewed. There is a question on the standard commercial insurance application that asks: “Has your insurance ever been cancelled or non-renewed?” You do not want to answer “yes” to that question. It looks real bad on your insurance history and it will haunt you for at least five years if it happens.

If you decide to open a self-performed roofing operation, you need to:

- Make sure your insurance company can accommodate the change in your business mix.

- Obtain cost estimates for increased insurance premiums for budgeting purposes.

Be sure to discuss your plans with your insurance agent before you hire anybody to perform roofing services in house.

Self-performed residential roofing should be a good source of new revenue for the restoration firms that capitalize on the opportunities that have been laid at their feet by climate change. The biggest barrier to entry could be obtaining compliant insurance coverage for the roofing services. There are specialty business insurance programs available both for full-time roofers and restorers going into the roofing business. The networks who are building out the self performed roofing capabilities are good sources of referrals on where to obtain insurance to meet their contract requirements as well.

If you can overcome the insurance obstacles roofing presents, the self-performed roofing business should be a winner for restoration firms. Especially for the firms in the high hail risk states.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!