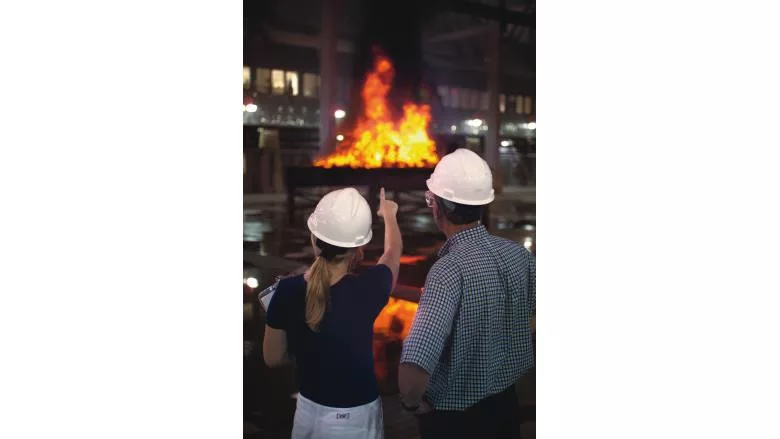

FM Global Introduces Resilency Credits

PHOTO COURTESY OF FM GLOBAL

Policyholders of commercial insurer FM Global will collectively receive approximately $300 million in “resilience credits.” The credits will provide them with means to invest in climate resilience solutions.

The credit has the potential to help those organizations reduce total loss expectancies related to wind, flood and wildfire exposure, according to FM Global data.

“With rising business disruption due to climate risk and companies increasingly focused on ESG strategies, the resilience credit is a potential game-changer for our clients, many of which are key contributors to the economy and society,” said Malcolm Roberts, president and chief executive officer of FM Global. “This credit is made possible through our mutual ownership structure and risk engineering focus to support their business continuity and climate risk mitigation efforts.”

The credit will be applied as a 5% premium offset against FM Global policies with renewals or anniversaries between Oct. 1, 2022, and Sept. 30, 2023, and will be calculated based on eligible in-force premium in effect 90 days prior to the renewal or anniversary date of the current policy.

In addition to the credit, later this year, FM Global will introduce a new suite of climate resilience solutions that can help clients assess climate risk exposures and prioritize their risk improvement investments.Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!