Nonresidential Construction Spending Decreases 1.1% in March, Says ABC

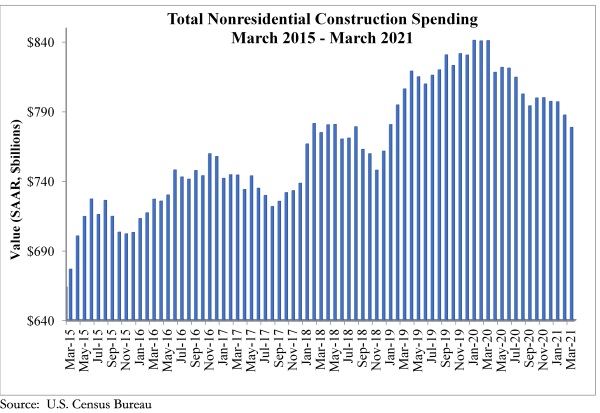

WASHINGTON, May 3—National nonresidential construction spending declined 1.1% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $778.5 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.9%, while public nonresidential construction spending fell 1.5% in March.

“While the longer-term outlook for nonresidential construction is superb, the pandemic is lingering, creating much damage to commercial real estate fundamentals,” said ABC Chief Economist Anirban Basu. “The lodging, office and commercial segments experienced declines in spending in March. Office vacancy rates are elevated in many markets, and the industry experienced negative net absorption. The trials and tribulations of hotel operators, retailers and restauranteurs are also well known. Private nonresidential construction spending is down more than 9% from March 2020.

“Public construction spending was weak in March and is down more than 5% on a year-over-year basis,” said Basu. “While large-scale federal infrastructure outlays are likely in the future, that money has yet to arrive. State and local government finances have generally held up far better than many had predicted earlier in the COVID-19 crisis, but many governments have had to spend significant operational sums to countervail the public health crisis and therefore had to redirect money away from infrastructure.

“ABC’s Construction Backlog Indicator has foreshadowed this state of affairs for months,” said Basu. “The most recent readings suggest that the construction spending recovery will be slow over the near-term. However, as the broader economic recovery picks up additional speed later this year with more pervasive vaccinations and re-openings, both private and public construction spending should begin to manifest more positive momentum later this year and into 2022.”

Nonresidential Spending Growth, Millions of Dollars, Seasonally Adjusted Annual Rate

| March 2021 | February 2021 | March 2020 | 1-Month % Change | 12-Month % Change | |

| Nonresidential | $778,517 | $787,374 | $840,764 | -1.1% | -7.4% |

| Conservation and development | $7,386 | $7,195 | $8,447 | 2.7% | -12.6% |

| Communication | $22,254 | $22,097 | $23,001 | 0.7% | -3.2% |

| Health Care | $45,527 | $45,339 | $48,004 | 0.4% | -5.2% |

| Sewage and Waste Disposal | $26,177 | $26,077 | $25,890 | 0.4% | 1.1% |

| Transportation | $55,733 | $55,753 | $56,896 | 0.0% | -2.0% |

| Office | $79,600 | $79,804 | $82,619 | -0.3% | -3.7% |

| Power | $113,829 | $114,235 | $123,855 | -0.4% | -8.1% |

| Commercial | $77,007 | $77,310 | $84,857 | -0.4% | -9.3% |

| Religious | $3,182 | $3,218 | $3,262 | -1.1% | -2.5% |

| Manufacturing | $69,379 | $70,321 | $75,278 | -1.3% | -7.8% |

| Amusement and Recreation | $24,230 | $24,692 | $28,123 | -1.9% | -13.8% |

| Educational | $100,590 | $102,694 | $107,492 | -2.0% | -6.4% |

| Highway and Street | $99,105 | $101,359 | $111,181 | -2.2% | -10.9% |

| Lodging | $23,075 | $23,649 | $30,096 | -2.4% | -4.6% |

| Water Supply | $17,173 | $17,637 | $18,005 | -2.6% | -4.6% |

| Public Safety | $14,270 | $15,997 | $13,758 | -10.8% | 3.7% |

| Private Nonresidential | $443,954 | $447,812 | $488,226 | -0.9% | -9.1% |

| Public Nonresidential | $334,563 | $339,562 | $352,537 | -1.5% | -5.1% |

Source: US Census Bureau

Visit abc.org/economics for the Construction Backlog Indicator and Construction Confidence Index, plus analysis of spending, employment, GDP and the Producer Price Index.

Associated Builders and Contractors is a national construction industry trade association established in 1950 that represents more than 21,000 members. Founded on the merit shop philosophy, ABC and its 69 chapters help members develop people, win work and deliver that work safely, ethically and profitably for the betterment of the communities in which ABC and its members work. Visit us at abc.org.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!