Exploring SBA Loan Options

Professionals in the restoration and remediation industry have seen a great deal of change over the years. However, a lack of financing sources or partners to the industry has seemingly remained constant.

As a business owner and contractor in the restoration/remediation industry, it is important to understand the options available for financing the acquisition or sale of a business. Buying or selling a business with cash or relying on seller financing to help facilitate a transaction are not the only choices. Another option is the Small Business Administration (SBA) loan program, which is designed to help small businesses rich in recurring cash flow but light in collateral accomplish their financial objectives.

The SBA loan program is administered by banks nationwide – over 1,800 banks make at least one SBA loan annually. The program allows a bank to operate outside of its conventional lending guidelines to lend to a small business based on its cash flow and the resume of the individual borrower. In exchange, the agency guarantees a portion of the loan to mitigate this risk, but there is a cost of doing business with the SBA. An SBA fee of around 2.5% of the loan amount, which is payable directly to the SBA, is charged to the borrower and in exchange, the business owner often enjoys longer loan terms, flexible collateral requirements, smaller down payment requirements, and less restrictions (i.e. prepayment penalties or loan covenants).

The down payment required for an SBA business acquisition loan is 10%, and for buyers who do not have the 10% in cash, then up to 5% may come in the form of a standby seller’s note.

The typical restoration and remediation business is able to benefit from this loan structure because there is a minimal cash down payment. This allows for the business to keep its liquidity levels higher, which may be used for operations and funding new jobs that translate to increased profits. Any business owner would be hesitant to inject a substantial amount of cash liquidity into a transaction if this meant less cash to fund business operations, but this is especially true for professional restorers who rely on adequate levels of operating capital in a cash flow intensive business. Furthermore, a loan with more favorable repayment terms and down requirements will allow the business to continue to focus on turning receivables, satisfying payables, serving customers, and looking after its employees.

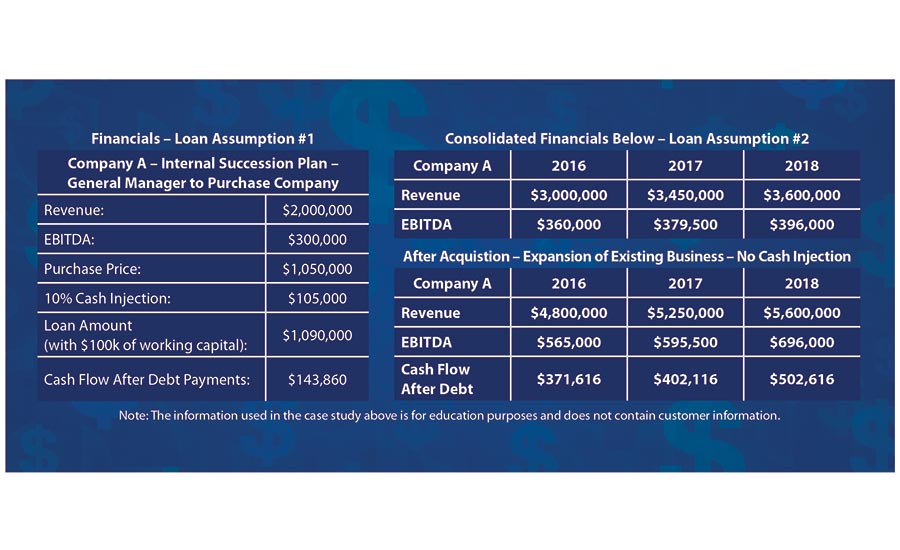

Let’s look at a case study of a restoration business acquisition and take a look at how the SBA program is structured and can meet an owner’s financial objectives.

Target Business has been identified with:

- $2M in revenue

- $300k in EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization)

- $1.05M purchase price (based on multiple of EBITDA)

- Not fully secured by collateral

Outcomes:

- Buyer able to expand territory or service capacity

- Assumption of client list and carrier network

- Increased sales based on past performance

- Profits increase after debt payments (est. annual payment of $193,383.72)

- Enhanced business operations create larger return for buyer

- More established brand & larger service area

- Consolidated personnel efforts

- Leverage one operating and lead management system

Financial Options:

Loan Assumptions #1 – Business Acquisition (First-Time Buyer):

- Owner uses an SBA loan to purchase their first restoration business

- Loan amount totals $1.09M – to include loan soft costs and $100k in working capital

- 10% down payment required ($105k) as this is a first-time buyer of a restoration company

- *If buyer doesn’t have 10%... 5% could come in form of a seller note.

- Payments stretched over 10-year term

Loan Assumptions #2 – Business Acquisition (Existing Business Owner):

- Existing owner uses an SBA loan to buy a second restoration business

- Loan amount totals $1.2M – to include loan soft costs and $100k in working capital

- Equity in existing business used for injection – no cash down payment required.

- Payments stretched over 10-year term

Knowing your options as a small business owner can help you grow your business, finalize your succession plan, and so much more.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!