Getting Free Insurance: A Play Out of Insurance Company Playbooks

Photo credit: oatawa/iStock / Getty Images Plus/ Getty Images

The best way to pay for a lawsuit is to get somebody else to pay for it. That is how most insurance companies have things set up when you do work under a master restoration services agreement.

Say you mess up on a job so badly that not only you get sued for the recovery of the property owner’s damages, but the insurance company paying for your work, or the direct-repair network or franchisor that sent you to the job, gets sued as well. In that situation your liability insurance is expected to pay to defend these other parties as well. In other words, the codefendants with you in the lawsuit do not pay; you do, or hopefully, if your insurance is designed properly to address this situation, your insurance company pays on your behalf. In risk management speak, the risk was transferred in a services procurement contract from the codefendant’s onto you and hopefully onto your liability insurance.

You can use that same risk transfer play with the subcontractors you hire. Subcontractors are the number-one source of liability claims in the fire and water restoration business. They are also the source of the very largest claims measured, in the millions of dollars. Basically, the source of these claims is the subcontractor messing up sufficiently bad on a job to trigger a lawsuit against the fire and water restoration firm that hired them, and sometimes the parties that sent the restorer to the job. Most lawsuits that involve the work of a subcontractor end up with the general contractor first. Below I will detail how to manage the subcontractor risk by stealing a play straight from the insurance company risk management playbook.

Way too often when a subcontractor’s actions cause the restoration firm to be sued, the subcontractor does not have adequate liability insurance in place to protect them or the restorer. This is a relatively easy situation to avoid with a good set of indemnity and insurance requirements in you subcontractor procurement contracts. If you are hiring subs without asking for indemnity, and to be an additional insured on their liability insurance policies, you are leaving access to free insurance on the table.

The good news is if you properly execute the managed subcontractor risk play, you can be fully covered under a subcontractor’s insurance at no additional premium charge to you or the subcontractor. In fact, the cost of your liability insurance should go down if you have a well-managed and insured subcontractor risk.

If you have ever worked for an insurance company under a master services agreement or through a direct repair network (a network), you have seen the managed restoration risk play. There are two parts to the managed restoration risk play.

- There is a defend, indemnity and hold harmless agreement where the vendor (you) agrees to pay for the harm they allegedly may have caused and not to seek money from the insurance company or network for possibly contributing to the loss.

- There is always a set of insurance requirements in the restoration services procurement contract designed to back up the indemnity agreement obligations you signed up for. As part of the insurance requirements, the contractor must make the network, franchisor or sometimes even the insurance companies an additional insured on the contractor’s liability insurance policies. Plus, there are a couple more enhancements, waiver of subrogation and primary insurance that are also required.

I will only give you the big picture of these provisions here, there are whole-day advanced, continuing education classes for insurance agents on additional insured coverage provisions.

Insurance companies are professional risk takers. Insurance companies have developed this method of managing the risks associated with fire and water restoration over decades; there is no reason to reinvent the wheel. Claims departments are particularly good at figuring out insurance coverage, so if an insurance company is saying they want a particular type of insurance — for example contractors pollution liability insurance — it is safe to assume they know what they are doing. It is a good model to follow their playbook.

How do you take this play from the insurance company playbook and use it in your firm to manage subcontractor risk? It’s a pretty simple process actually. First there needs to be a defense, indemnity and hold harmless agreement in your services procurement contract with your subcontractors. You would be well-advised to consult a lawyer for that language. Some franchise organizations have pre-set subcontractor agreement templates that are usually pretty good on the indemnity language; although I have seen some really messed up insurance requirements in the past coming out of franchisors.

Next you will need a set of rock-solid insurance requirements. Below I am only giving the big picture. Insurance requirements are necessarily detailed. These lack sufficient detail for use. If you need to upgrade your insurance requirements, there are risk management consultants and lawyers that specialize in construction contracts that can help. A qualified construction risk specialist insurance agent may be able to provide insurance requirement templates to follow. At ARMR, we have written a few insurance requirements for firms in the restoration space. If you need help, give us a call. It is worth getting them right because if you do, you are getting free liability insurance from your subcontractor’s.

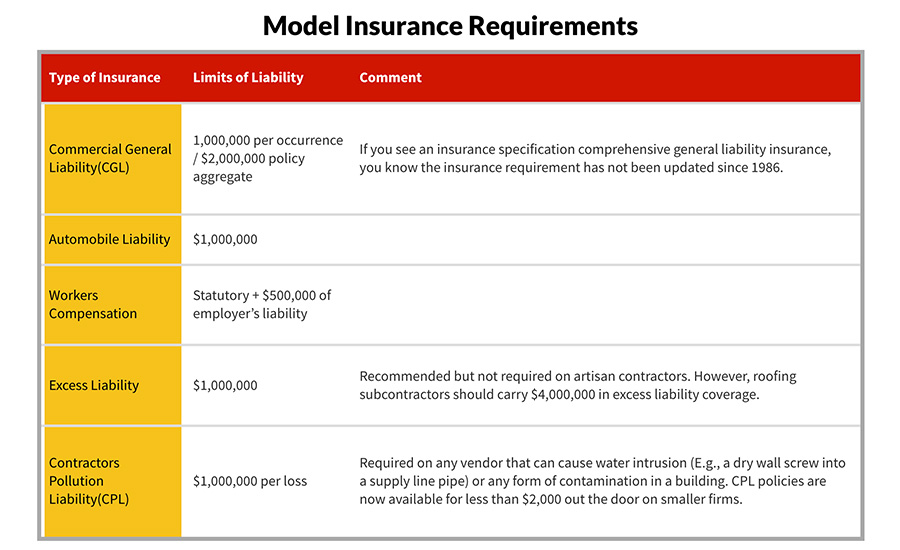

Model Insurance Requirements

Click to enlarge

Other Needed Insurance Provisions

The above coverage must provide primary, and the CGL, auto and CPL must be non-contributory coverage. These policies must provide a waiver of subrogation.

A certificate of insurance showing the restorer is an additional insured for the required coverages shall be furnished.

And here is the magic part:

The CGL and CPL must provide contractual liability coverage and make the restoration firm hiring the subcontractor an additional insured for the ongoing and completed operations of the subcontractor.

Contractual liability is a built-in coverage in the modern off-the-shelf CGL and most CPL policies. Additional insured coverage is an endorsement to these policies and is usually granted on a blanket basis at no additional premium charge at the inception date of the policy.

A blanket additional insured endorsement basically says the insured party can make anyone they are performing operations for an additional insured if these three things are in place:

- There must be an indemnity agreement with the party seeking to be an additional insured.

- The specific type of insurance with additional insured coverage must be required.

- With these two things in place, in most blanket additional insured endorsements to the GL and CPL policies, the additional insured coverage applies for the work the named insured performs for the additional insured at the location of the additional insured party.

How beautifully simple. The cost-free coverage to protect you as an additional insured is basically built into off-the-shelf CGL and CPL policies purchased by subcontractors. But you need to ask, in a contract or agreement, for the specific insurance coverage to be an additional insured. If you do not ask, the value of the subcontractor’s liability insurance to protect you before your insurance needs to kick in is squandered.

Insurance companies manage their risks in the restoration process by attempting to secure the benefits of the restoration firm’s liability insurance through insurance specifications. They do this either in the master services agreement or through a flow down of the indemnity and insurance requirements in a direct repair network’s contract with a restorer. The flow down of liability ultimately landing on the liability insurance policies of the restorer is a designed play. Like a designed football play, every player on the field has an assignment to fulfill in the playbook. When everyone does their job, the designed play works as planned. But like the football lineman that blocks the wrong defender leading to a hole in the line and the sacking of the quarterback for a 20-yard loss, well-designed risk management plays can blow up too with missed assignments.

A common cause of risk management blow-ups in the restoration business is nonfunctional additional insured coverage. This is especially prevalent in the direct repair network business where, today, 90% of the restoration firms in these networks have less-than-perfect additional insured coverage on the general liability insurance policies they buy. When working for a network, the contractors are not working for the party seeking to be an additional insured (the network) at that network’s location.

The restorer is not working for an insurance company either. They are working for the policyholder. Blanket additional insured wording commonly found in general liability insurance policies does not function in those examples, which explains the extremely high failure rate to meet the insurance specifications in network contracts.

To overcome this common insurance coverage flaw, it is common to see specific additional insured requirements in the direct repair network contracts. But even with the detailed insurance requirements, there is a huge failure rate because in way too many cases, insurance agents have not been given the playbook by the restoration firm. As a result, the insurance agents are out of position for the play. The well-intentioned insurance agents unwittingly set their restoration clients up to be sacked by issuing certificates of insurance that represents all the needed insurance coverage for the network is in place, when in fact it is not.

To avoid being sacked with an uninsured indemnity demand by a party that expects to be an additional insured, be sure to always provide your insurance agent the complete services contract you need insurance for and tell them you are not going to be working for that party at all. You are working for a property owner that has an insurance claim and, for example, you are not going to be working at the home office of the direct repair network either.

To avoid not having liability insurance to back up your obligation to defend your codefendants in a lawsuit who expected to be an additional insured on your liability insurance policies, you need to read the blanket additional insured coverage endorsement in your general liability policy, looking for those two caveats to be an additional insured. If you find them, you will need to procure a functional additional insured endorsement for your network or master services agreement jobs. These customized endorsements are readily available in liability insurance packages purpose-designed for use by fire and water restoration companies. We sell thousands of these policies through local insurance agents in every state. They are not hard to access.

The good news is the additional insured coverage glitch that nine out of 10 readers of this article will have if they work with a network for job assignments, is not a problem when you hire a subcontractor to work at one of your job sites. Additional insured endorsements work well in a general-contractor-to-subcontractor relationship. However only a customized additional insured endorsement works for network and master services agreement jobs.

And how does it work when there is an indemnity obligation in a contract with a requirement to make the other party an additional Insured, when there is defective insurance in place to back up that obligation? The indemnity agreement is still effective. If there is a claim against the general contractor and the subcontractor, the subcontractor will need to pay to defend and indemnify out-of-pocket the party that expected to be an additional Insured. If you are working for a network and your additional insured coverage extension is dependent upon you performing operations for the additional insured party at their location, you have been set up by the indemnity agreement you signed to be the insurance company for the network. That is a crazy situation since the needed coverage for an additional insured is a cost-free, built-in coverage extension to CGL and CPL policies.

It should be cost free to add a party as an additional insured on the normal renewal date of the policy holder. However, a mid-policy-term request to issue a customized, additional insured endorsement is likely to trigger an additional premium of some amount, usually measured in the low hundreds of dollars. The solution here is simple: just wait for the vendor’s insurance renewal date to implement your additional insured risk management strategy.

Conclusion

Restorers can learn a lot from the insurance company playbook on how to manage restoration risks. With a good subcontractor agreement that has solid insurance requirements, many of the most expensive losses in the restoration business can be offloaded on a primary basis onto the subcontractor’s liability insurance policies. The trick is the execution of the play by all the players on the field. That’s happening in about 10% of the restoration firms today.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!