CoreLogic: 86,000+ Homes at Risk From Southern California Fires

CoreLogic Analysis Shows More Than 86,000 Homes in Southern California at Risk from the Thomas, Rye and Creek Wildfires

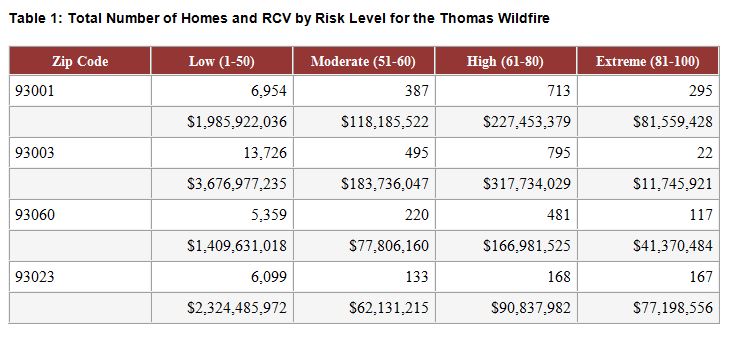

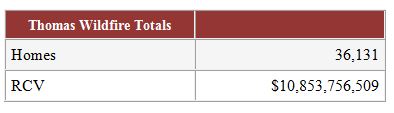

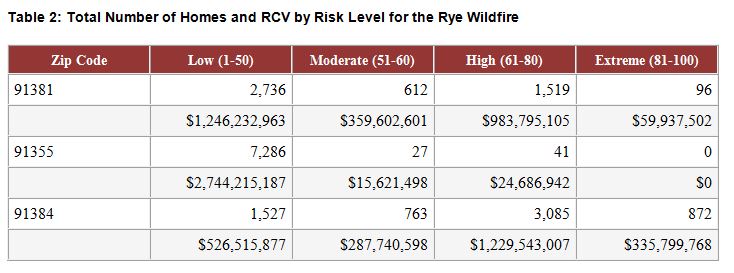

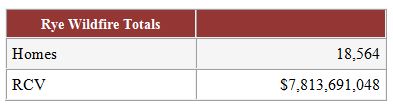

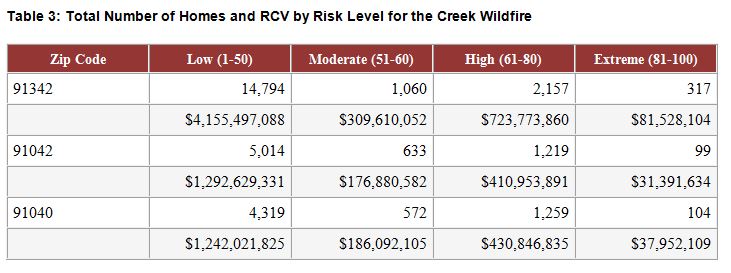

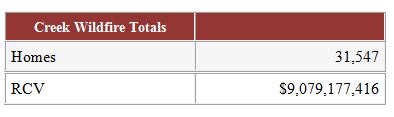

According to CoreLogic© hazard risk analysis, a total of 86,242 homes in Ventura and Los Angeles counties with a combined reconstruction cost value (RCV) of $27.7 billion are at some level of risk from the Thomas, Rye and Creek Wildfires.

Of the total at-risk homes, 13,526, or 16 percent, with an estimated RCV of more than $5 billion are at significant risk of damage, falling in the High and Extreme risk categories, according to CoreLogic data. Although the majority of homes, 72,716, or 84 percent, are at Low or Moderate risk of damage, wildfire can easily expand to adjacent properties and cause significant damage even if a property is not considered high risk in its own right.

Tables 1-3 show the total number of homes and RCV at risk by zip code for each of the three wildfires. These figures are based on the CoreLogic Wildfire Risk Score (1-100), which indicates the level of susceptibility to wildfire damage and includes risk associated with the property's location and its proximity to other high-risk properties or areas. The higher the score, the greater the risk of damage.

The reconstruction cost values represent estimates to rebuild the home, taking into account geography, labor and materials, and are based on 100-percent, or total, destruction. Depending on the size of the wildfire, there can easily be less than 100-percent damage to the home, which would result in a lower realized reconstruction cost. As such, this analysis represents the total and maximum risk from this event, not the predicted loss.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.c om.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!