Corelogic Analysis: Hurricane Florence Damage Estimates

The Aftermath of Hurricane Florence is Estimated to Have Caused Between $20 Billion and $30 Billion in Flood and Wind Losses, CoreLogic Analysis Shows

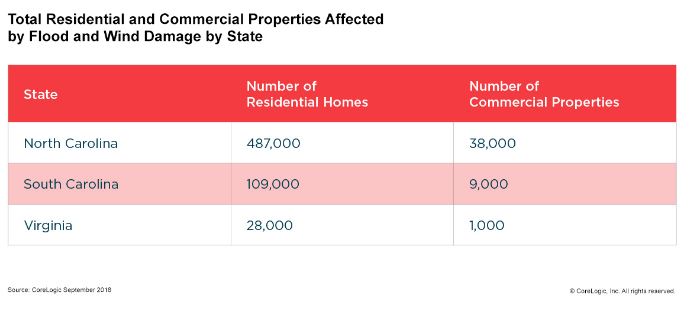

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today announced updated residential and commercial flood and wind loss estimates for Hurricane Florence. According to this new data analysis, flood loss for residential and commercial properties in North Carolina, South Carolina and Virginia is estimated to be between $19 billion and $28.5 billion which includes both storm surge and inland flooding. Specifically, uninsured flood loss for the same area is estimated to be between $13 billion and $18.5 billion. Wind losses are estimated to be an additional $1 billion to $1.5 billion.

This analysis includes residential homes and commercial properties, including contents and business interruption and does not include broader economic loss from the storm.

- Insured flood loss covered by the National Flood Insurance Program (NFIP) is estimated to be between $2 billion and $5 billion.

- In these states, 445,000 total residential and commercial property policies are in force through the NFIP

- Insured flood loss from private insurers is estimated at less than $5 billion.

Insured loss represents the amount insurers will pay to cover damages. Unlike wind damage, which is covered by a standard homeowners policy, flood is a separate coverage, which is not mandatory outside the designated Special Flood Hazard Areas (SFHAs).

For major Gulf and Atlantic Coast hurricanes that impact the U.S. this year, CoreLogic is planning on providing pre-landfall data for the number and associated reconstruction cost value (RCV) of at-risk homes as well as a secondary set of pre-landfall data for estimated insured property losses for wind and storm surge. For post-landfall data, CoreLogic plans to issue insured and uninsured property losses for wind, storm surge and additionally flood. Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at to get access to the most up-to-date Hurricane Florence storm data and see reports from previous storms.

Methodology

The U.S. Inland Flood Model models all sources of precipitation-driven flooding including riverine, stream, off-plain, and flash flooding. It delivers a comprehensive analytic view of the risk, utilizing widespread coverage of hydrologic and hydraulic data that reflects regional flooding and drainage patterns. As flood risk evolves due to urbanization and change in baseline stream and sea levels, the flood risk methodology from CoreLogic is designed to stay abreast of the latest flood risk data and research, ensuring continuity of risk insights into the future.

The CoreLogic North Atlantic Hurricane Model includes improved location risk and estimation through its robust stochastic event set, high-resolution hazard modeling, component-level vulnerability, and usage of PxPoint™, the structure- and parcel-level geocoding engine. With detailed and rigorously validated model outputs, the model provides the ability to calculate damage contributions from wind and storm surge, providing a transparent way of looking at loss as well as to obtain a better understanding of capital adequacy for the separate or combined perils of hurricane winds and coastal storm surge flooding. The model offers a complete view of the risk for all perils and sub-perils. The North Atlantic Hurricane Model is updated biennially and has been certified by the Florida Commission on Hurricane Loss Projection Methodology (FCHLPM) since the inception of the process in 1997.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Alyson Austin at newsmedia@corelogic.com or Caitlin New at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit Corelogic.

Source: CORELOGIC, the CoreLogic logo, Hazard HQ and PxPoint are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!