The #1 Question on Contractor Pollution Liability

Occurrence vs. Claims-Made Policies

It is not often that you find restorers without Contractor Pollution Liability (CPL) these days, as it is required by almost all TPAs, insurance companies, property managers, and anyone else who might send you work. There may be many holes that can be found in your current policy, which is another subject entirely, but today I want to help you understand the single biggest question when purchasing CPL: “Is it Occurrence or Claims Made?” I feel that an educated buyer must understand the difference of the two types of claim triggers.

Occurrence

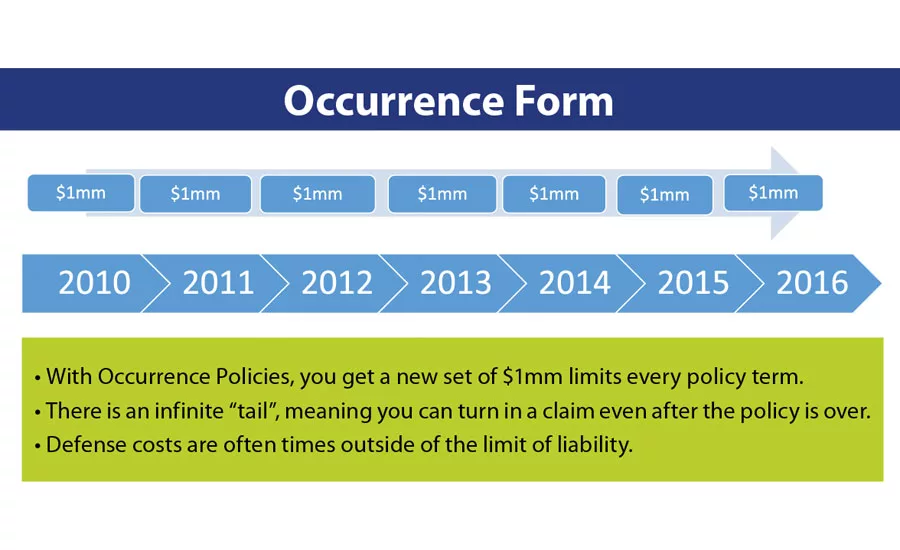

Timing: An Occurrence policy protects you from any covered incident that “occurs” during the policy period, regardless of when a claim is filed. An occurrence policy will respond to claims that come in – even after the policy has been canceled – so long as the incident occurred during the period in which coverage was in force. In effect, an Occurrence policy offers permanent coverage for incidents that occur during the policy period.

Limits: Each year an Occurrence policy is in force represents a separate set of limits. Ten years of coverage under a $1M/$2M Occurrence policy could provide the insured protection for up to $20MM in claims (ten year combined annual aggregate limit).

Claims-Made

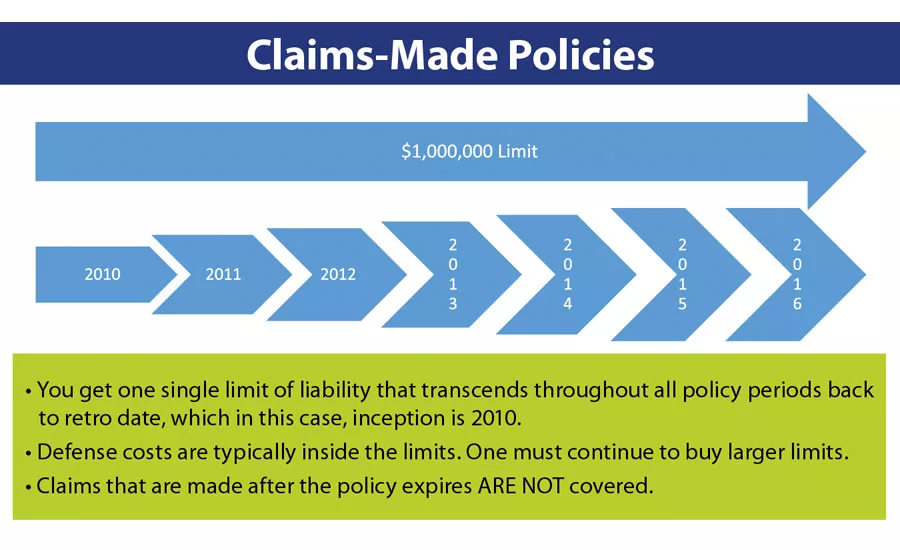

Timing: Claims-Made policies provide coverage for claims only when both the alleged incident and the resulting claim is made during the period the policy is in force. Often times, there is also a provision that the claim must be reported to the carrier during the policy period, or any extended reporting period. Claims-Made policies provide coverage so long as the insured continues to pay premiums for the initial policy and any subsequent renewals. Each succeeding year the policy is continuously renewed, the “coverage period” is extended. Once premiums stop, the coverage stops. Claims reported to the insurance company after the coverage period ends will not be covered, even if the alleged damage occurred while the policy was in force.

Limits: With Claims-Made, you get one set of policy limits that transcend through all policy periods back to the Retroactive Date. The policy limits in place when the policy is purchased remain the single set of limits available to protect the insured from all claims that could arise from service provided during the years the policy is continuously in force. Although your limits will replenish upon renewal, you are tied to one aggregate limit going back to the Retroactive Date. As an example, you purchased a $1M/$2M Claims-Made Pollution policy in 2010 and it is now 2016. Say three separate claims are made in 2016 that all end up being $1M from work that you did in 2012, 2013 and 2015. With Claims-Made, where you have one limit back to the retro date, unfortunately, there would only be $2M of limits for $3M worth of claims. Whereas with Occurrence, if the damages occurred during the three separate policy periods, it would trigger three separate sets of limits. Also, Defense Costs are typically inside the limits with Claims-Made.

Extended Reporting Period (ERP) – “Tail Coverage”

One of the issues with Claims-Made policies is that all coverage ceases once you do not renew and stop purchasing the coverage. In almost all Claims-Made policies, there will be an option to purchase an ERP for one to five years. It is common to see carriers charge three times one year’s of premium for a three year Tail. For example, your CPL costs $10k annually, it could cost $30k for the ability to turn in a claim up to three years after the policy ends. Since the statute of limitations in most states are seven to ten years, there are no Tails available that could give you complete peace of mind. Again, with Occurrence, you do not have this issue as there is an infinite Tail already provided.

Prior Acts Coverage – “Nose Coverage”

It is a safe bet that 80-90% of insurance brokers do not even know what a Nose is, so do not be shocked if you have never heard of this before. As stated above, once a Claims-Made policy ends, there is no more coverage. Therefore, if you change to Occurrence from Claims-Made, you can have a huge gap in coverage if you do not address the fact. Anytime you make that transition, the broker must add a Nose.

By adding a Nose, the carrier essentially picks up all that Claims-Made coverage back to the retroactive date, and turns it into Occurrence. One may say, “Why would a carrier pick up liability from a coverage period where they did not even get paid a premium to do so?” The fact is that not all carriers are willing to do this and they are usually going to get a fair amount of premium to do so. Still, in a time where the market is “soft”, and carriers’ minimum premiums have dropped as low as they can go, some insurance carriers will write a Nose in order to secure the account. We are in a time now where the pricing is so low that the carriers have to give more coverage away in order to compete. If done correctly, writing a Nose is one of the most positive innovations on the market today.

Outside Perspectives

Don’t just take my word for it. To take it a step further, I have interviewed three gentlemen who work for carriers who write millions of dollars in premium for the restoration industry and can give us the perspective from an underwriting stance. A special thank you to:

Orlando Castaneda

Sr. Underwriter, Environmental Liability

– CapSpecialty

Joshua Bowen

VP, Environmental Casualty

– Crum & Forster

Marsh Duncan

SVP, Environmental Underwriting

– Colony Specialty

1. Which is better for the insured, Occurrence or Claims-Made? Why?

MD: Occurrence-based coverages are generally considered more favorable for insureds. Unlike, a Claims-Made policy, the damages do not have to be reported prior to the end of the policy period or during an applicable extended reporting period.

2. In which instance does the carrier have more at risk? Why?

OC: In my opinion, the carrier has more risk when the policy has been written on Occurrence basis. The downside of Claims-Made policies is the lack of continuing of coverage, which will not give the insured all the needed retroactive coverage. There is also a possibility that some carriers will not honor older retroactive dates, obligating the insured to either move coverage elsewhere or move their retroactive date to an earlier one.

3. Have you ever seen someone make a claim while they were exercising the three year tail (ERP)? What happened?

JB: I have seen people exercise a Tail multiple times. In fact, more people should be purchasing it as construction defects are the most prevalent. The biggest one I have seen was on a commercial development where there was a significant amount of contamination that needed to be cleaned up. The project was written with Claims-Made Pollution and they purchased the Tail at the end of the job. Two years later, soil vapor contaminants were coming up to the mixed use retail/apartments. Contaminated dirt was moved and they build on top of it.

4. Can you remember a time that someone did not purchase a tail (ERP), they tried to turn in a claim, and it was denied?

OC: We once wrote a package policy that included Professional Liability to cover Mold Assessment. As the insured was not getting a lot of work, he decided to non-renew his policy and did not buy an ERP for the professional services. A claim was later submitted where the claimant alleged that the mold sampling at his house was inaccurate. The claim was denied as the policy already expired and the insured had to incur on their own defense and indemnity expenses.

5. Have you or would you ever consider pushing a retro date back to a date prior to the first time an insured purchased a Claims-Made policy? For example, someone starts a restoration business in 2014, but does not buy Pollution until 2016.

MD: No, that is generally not the case. Coverage should be purchased prior to the beginning operations.

JB: I have heard of it, but there is a conflict in doing that. Typically, I would not push back the retro because it is a business decision for the insured to not purchase the coverage when they need it. If we do push it back, it will not be free and we would likely charge premium for that time. In my experience, I have not pushed it back for more than a couple months, but it has never been for a service contractor.

6. Have you ever seen a claim where pollution damages took place over multiple policy periods, the insured had Occurrence, but the carrier denies the claim because they could not figure when the date of loss actually was?

OC: Not under an Occurrence policy. On Claims-Made policies, it is common mostly due to spills where it is hard to determine when the release started.

JB: I have seen where carriers try to deny coverage, but the court generally steps in and gives a quota share judgement.

7. Of course we need to add a Nose if you are switching from Claims-Made to Occurrence, but what are some things to look out for?

OC: There are several Nose forms to choose from and it is important to understand what the Nose form is offering. The key element of the Nose endorsement is the sunset date or if the Nose form is limited to convert the coverage from Claims-Made to Occurrence just for that particular policy period. If this is the case, the agent needs to make sure to get that form every single year in order to not lose or have lapse in coverage. The best Nose form, in my experience, is the one that converts the CM coverage to occurrence with a N/A sunset day. This way, the insured will not need to be concerned about the form being moved every single year, which then avoids lapse in coverage.

8. Have you ever written a Nose and then picked up a claim from a policy period where you did not even collect premium?

OC: Yes. There was an instance where we ended up paying a large claim on an environmental consultant where the insured reported inaccurate findings on a phase I report. A post office was built at the location, and then due to contamination at the site, the USP office had to be demolished to clean up the site.

Anyone who tells you Claims-Made is better than ccurrence is not your friend.

Rarely do I hear agents say Claims-Made is better. If they did, it could be a number of reasons. Some may not have access to markets who offer Occurrence CPL and/or mold. It’s possible they get higher commission with the carrier offering Claims-Made. It could be their allegiance is to the carrier, not the insured. The most common reason is simply the lack of experience managing the risks of restorers.

You can see Claims-Made is less risky for carriers and Occurrence is more beneficial for insureds. Generally, for companies in the restoration industry, Occurrence Pollution should be obtainable. That said, if a company has been riddled with claims or has a retro date going back more than ten years, Occurrence will be harder to acquire. It is more than my opinion, as almost every underwriter would agree a restorer should choose Occurrence over Claims-Made if it is available.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!